Top 6 Finance App Ideas For a Startup to Consider in 2026

Here are the most profitable financial apps ideas. Take a look!

People are gradually getting rid of cash in their wallets, and even wallets themselves are being replaced by their online counterparts. But this is not the limit of the scope of modern finance app ideas. Keep floating through the article to find out the best FinTech startup ideas and start implementing them right away.

We also feel it's our duty to cheer you up, so look: while launching a startup is always a challenge per se, the FinTech industry keeps growing and is expected to reach $188 billion by 2026. Compare it with the revenue of $90.5 billion back in 2017—over 100% growth within only 7 years!

Here, we can surmise that a FinTech startup has every chance of succeeding if it enters the rapidly growing industry correctly and is backed up by a robust business strategy.

FinTech App Development: Top Technologies to Employ

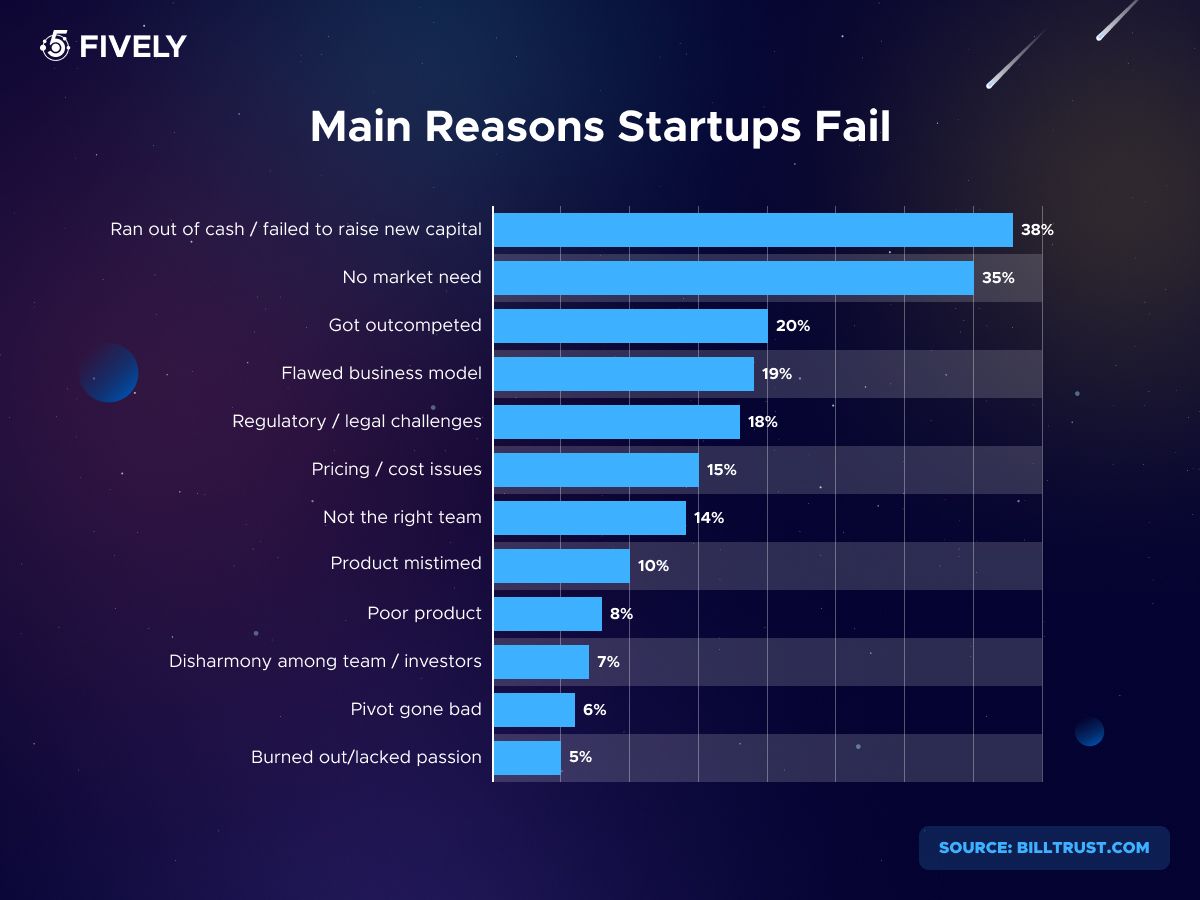

A post-mortem research shows that one of the main reasons for startups to die is a lack of market demand for their product. Why does this happen? In a happy-go-lucky manner, the failed startuppers decided not to conduct any market research and take into consideration the current software development trends and the peculiarities of the industry.

If only they had asked an experienced FinTech app development company or their seasoned comrades for advice, they could have averted the failure. As we desire to join the ranks of the much more optimistic statistics mentioned above, let's take a look at some of the cutting-edge features and technolgies to incorporate into your future FinTech app.

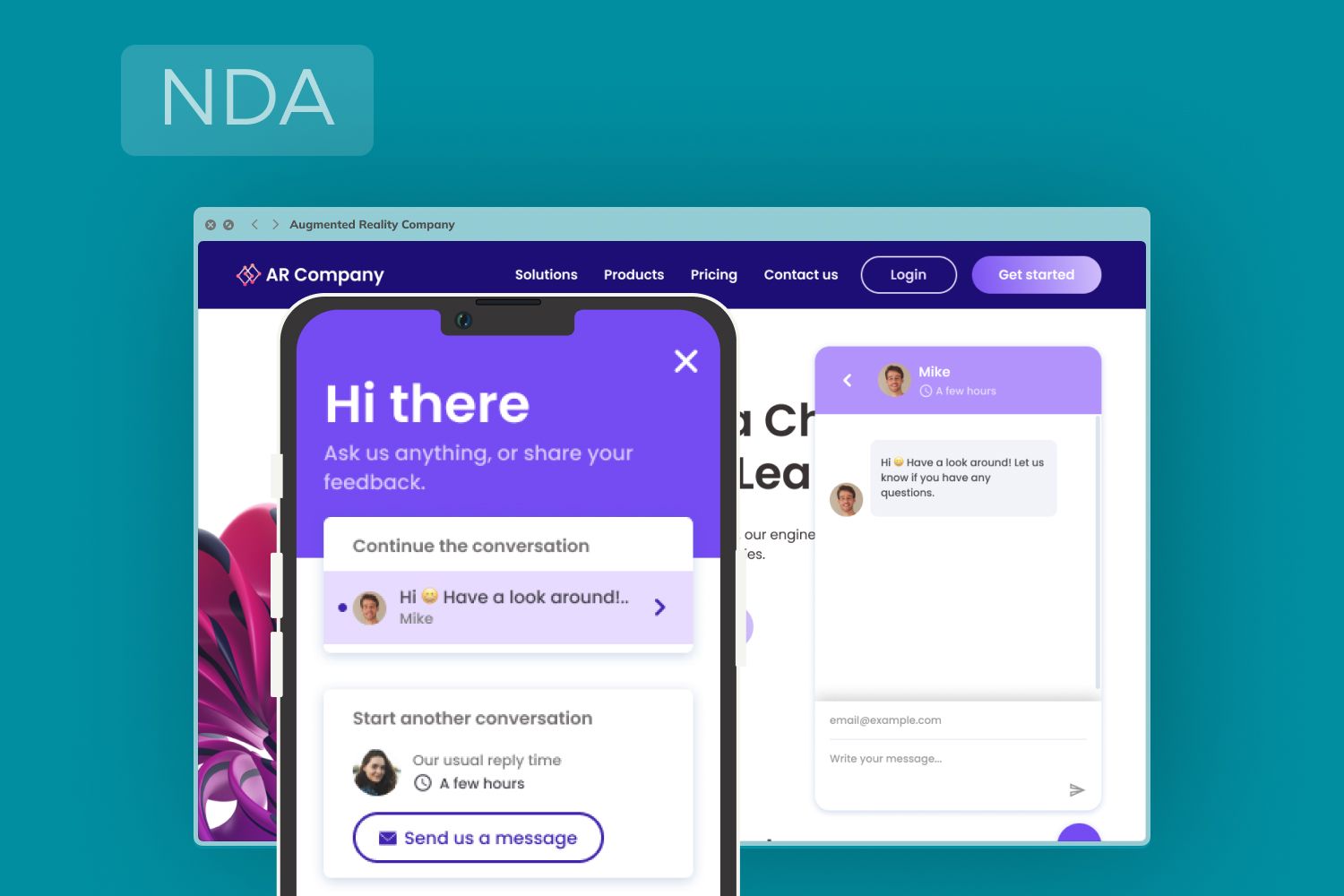

AI and Big Data

Unimaginable features can be added to your app with these technologies, from Automation and System Integration and AI-powered chatbots to detecting suspicious activity and content personalization. For example, you can make your personal finance management app send a user personal advice according to their recent spending or the purchases they’re likely to make soon.

If businesses are your target audience, you could provide them with a feature that tracks their financial activity and provides clear analytics that even non-financial experts can understand.

Blockchain

Initially, blockchain technology was associated with only cryptocurrency, but now it's used to introduce an unprecedented security level to software. It boils down to the data being stored in so-called "blocks," i.e., not as a single centralized chunk, which makes it extremely difficult for hackers to break.

Data security should always be at the center of every FinTech development project. And blockchain is a great technology for this purpose.

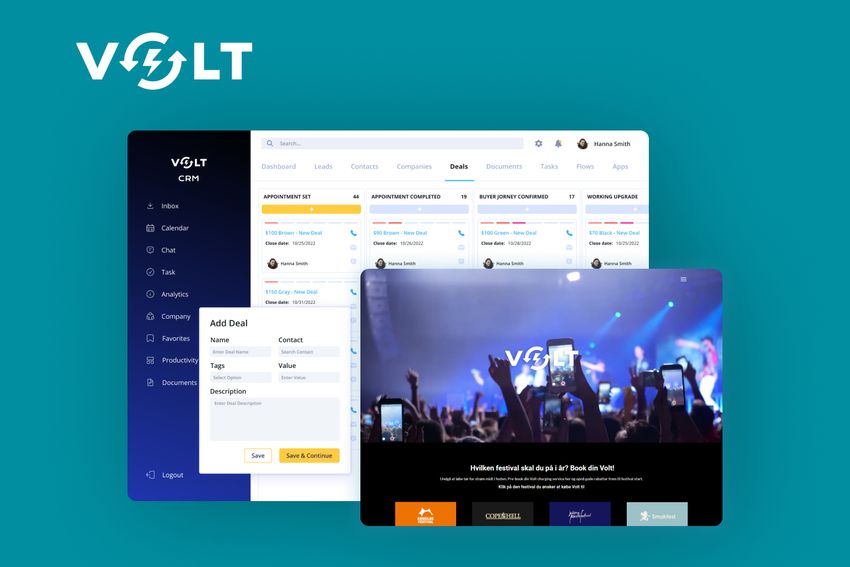

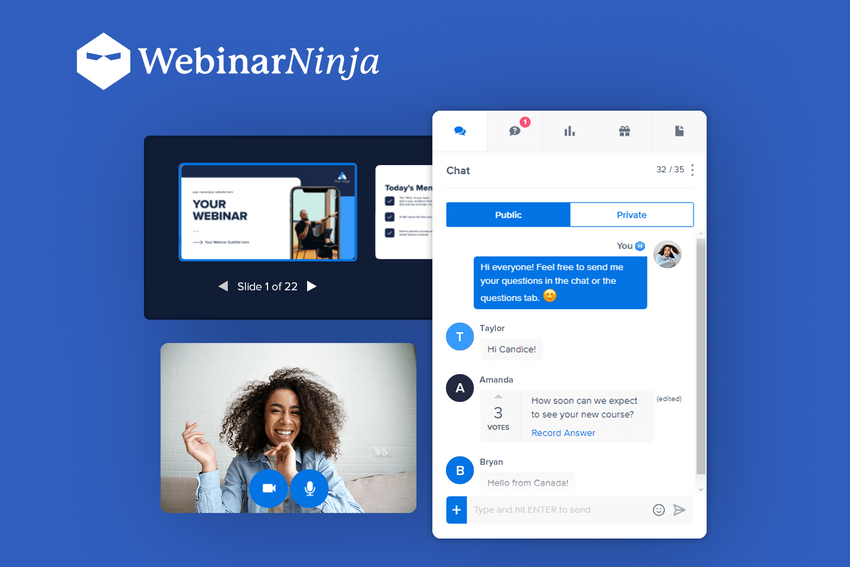

SaaS approach

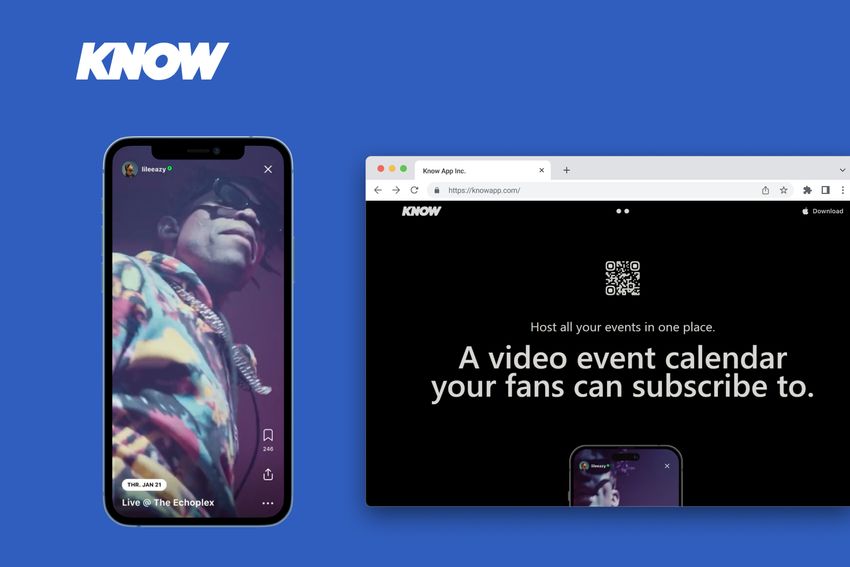

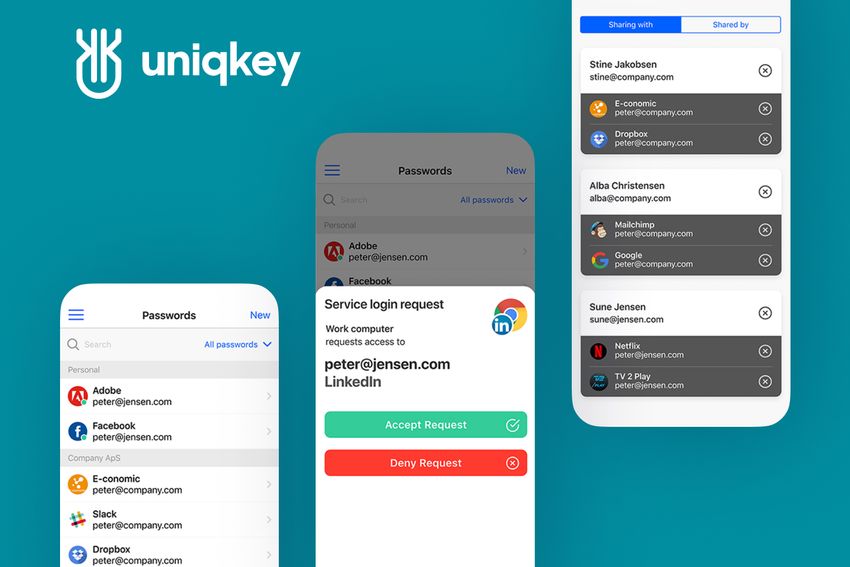

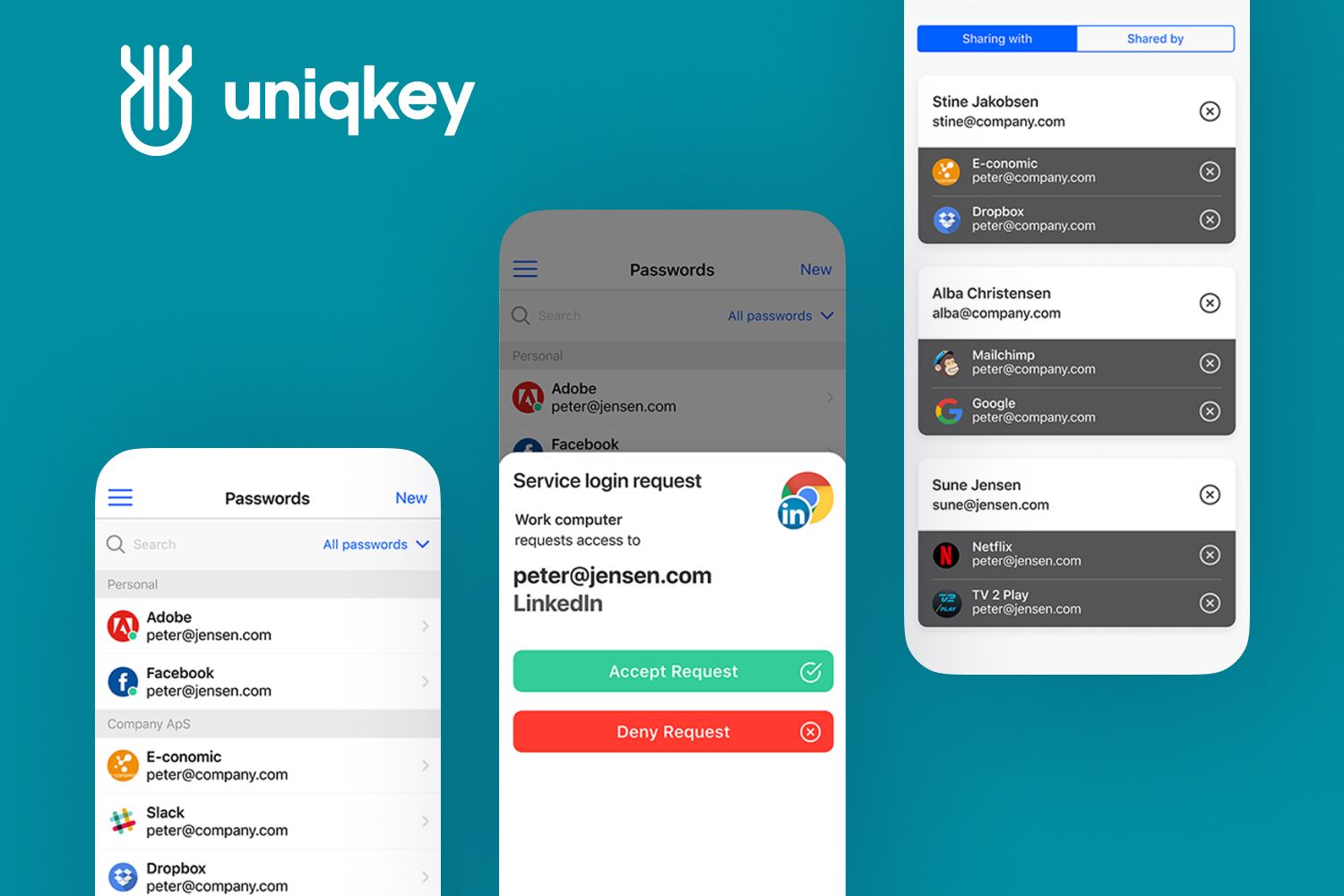

Often, businesses are not willing to invest in their own software development and resort to SaaS (Software-as-a-Service). The concept is simple: you create a platform that is rented by various companies for a specific time period, and once there’s no need for your app, these companies terminate their subscriptions.

For instance, one of the solutions for Identity-Access Automation management is a SaaS-based website that automatically generates passwords and logins for workers. Obviously, it’s much more efficient for businesses to rent similar functionalities rather than build their own passwords managers from scratch. Take a look at other ideas of SaaS for small business in FinTech and other industries.

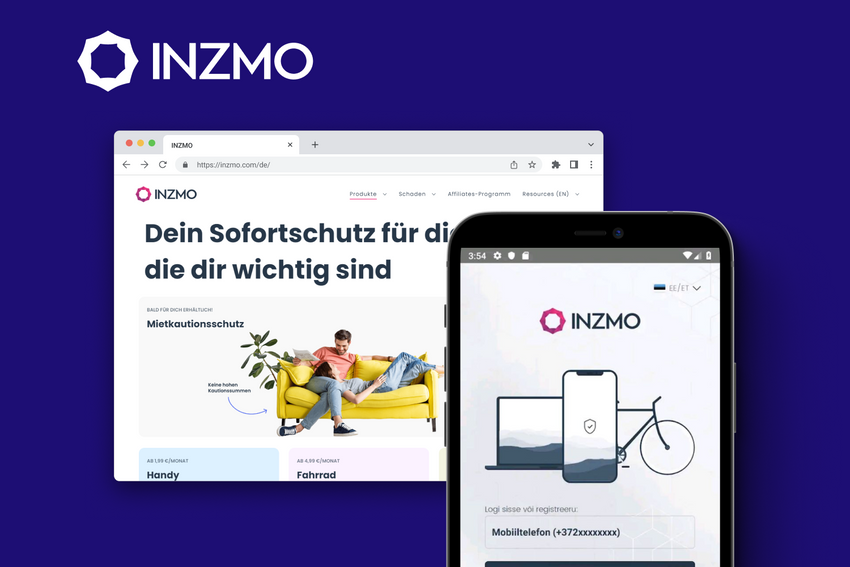

Biometrics

While there are still many ardent opponents of sharing body data with evil computers, biometrics presents another means to keep your FinTech app protected from remote cyberattacks with a face, fingerprints, and even the voice—in general, any unique feature of a human that is impossible to imitate.

It can be used to conduct specific types of financial transactions, such as money transfers, the creation of new credit cards, or simply unlocking an app.

IoT

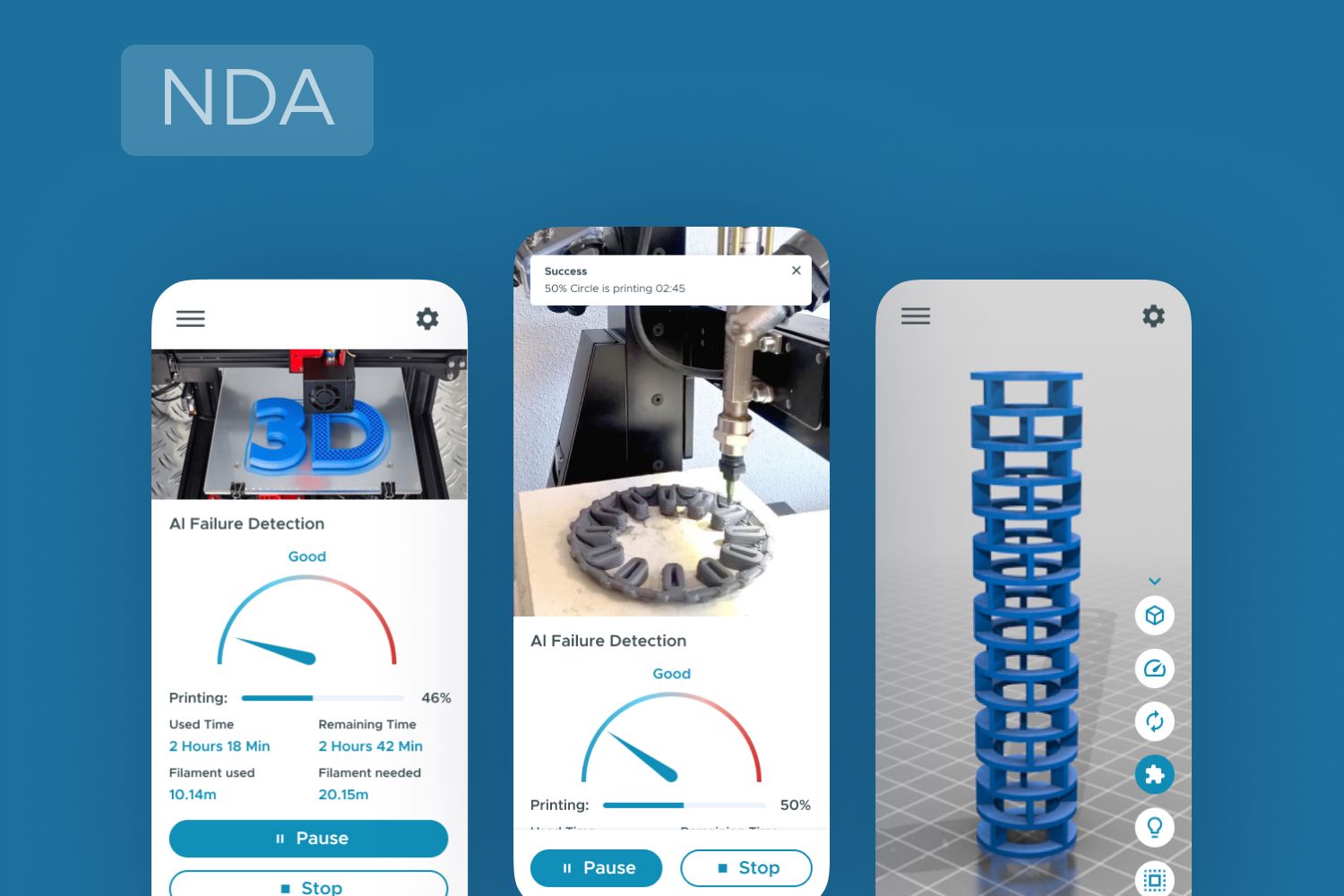

It’s Artificial Intelligence, Machine Learning, and Big Data all together to be praised for IoT technologies. It usually works like this: special IoT sensors send the data gathered to the cloud, where this data is analyzed and then presented on a user’s screen.

In FinTech, IoT is used for ATMs, wireless NFC payments, and motion-sensitive security cameras. By the way, there is an app for smart watches that can record a user’s heartbeat to give them access to a digital wallet—a perfect amalgamation of biometrics and IoT.

Open banking

Open banking is claimed to be the future of every business that provides financial services and BaaS. This technology allows apps to access users’ personal financial data via APIs, thus making it possible to analyze their behavior and give relevant advice. One of the startup ideas in FinTech is an app that offers users the best insurance option based on their recent financial transactions.

Open banking can also greatly facilitate B2B marketplace development by managing accounts from different banks and automating payment processes.

Gamification

There is always space for creativity, even in such a field as FinTech. Everyone loves entertainment, especially when it helps to build healthy habits and learn financial literacy. One of the most popular personal finance application ideas is rewarding a user every time they’ve managed to save or earn a specific amount of money.

It can take different forms. For example, it can be a garden that grows with every saved dollar or the new types of buildings that make a city.

6 Fintech Startup Ideas to Start Implementing in 2026

Let us be your guiding light on the road to becoming a top FinTech startup and show you a glimpse of finance application ideas. They serve only as a blueprint for your one-of-a-kind software, which should not only be enhanced with all the modern technologies described above but polished with a unique vision of your own. So, as you study the list, try to already start processing in the back of your mind how you can reveal your business philosophy through it.

Peer-to-Peer payment apps

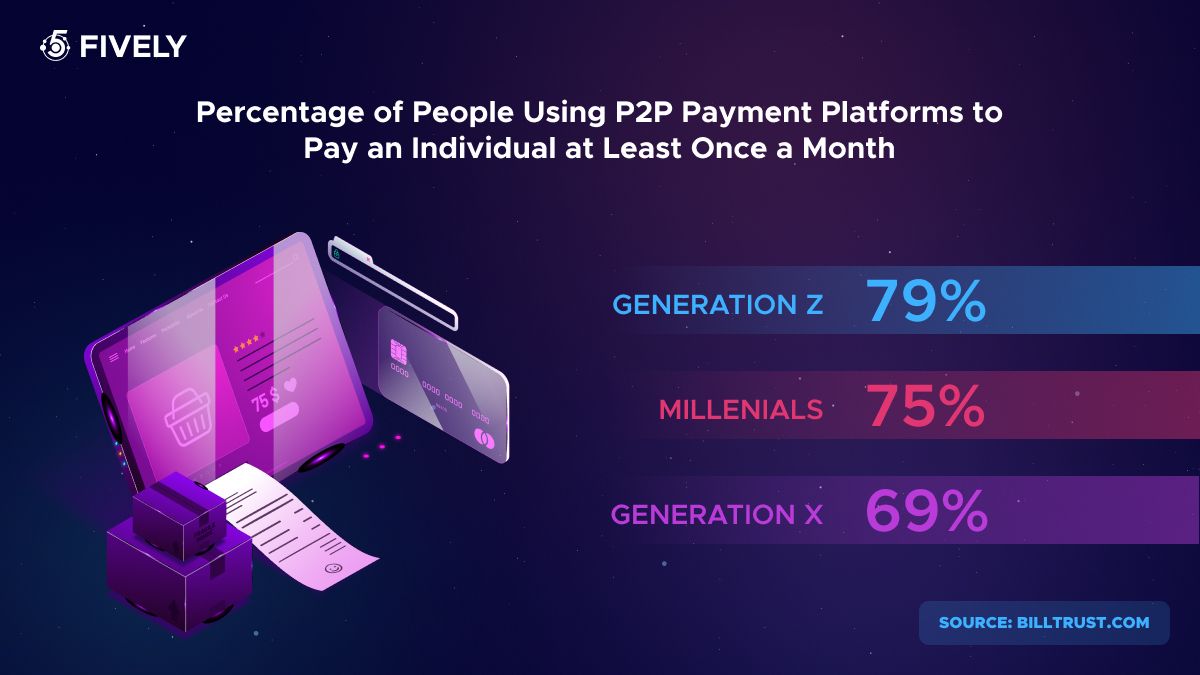

This FinTech startup idea is about creating an app that would make it easier for people to send each other money. Research on the preferences of Gen Z, which is claimed to be the most influential generation, shows that 79% conduct P2P transactions at least once a month.

Such apps can be used to pay back money borrowed or simply split a dinner bill. By the way, you can find FinTech app developers who will be able to build a P2P app with a "Trust but verify" concept for safe lending and guaranteed repayment under certain conditions.

Many similar apps limit users in the number of banks and currency available or don’t feature a striking UX. Take a step forward and ponder how you can augment a standard P2P app.

Crowdfunding apps

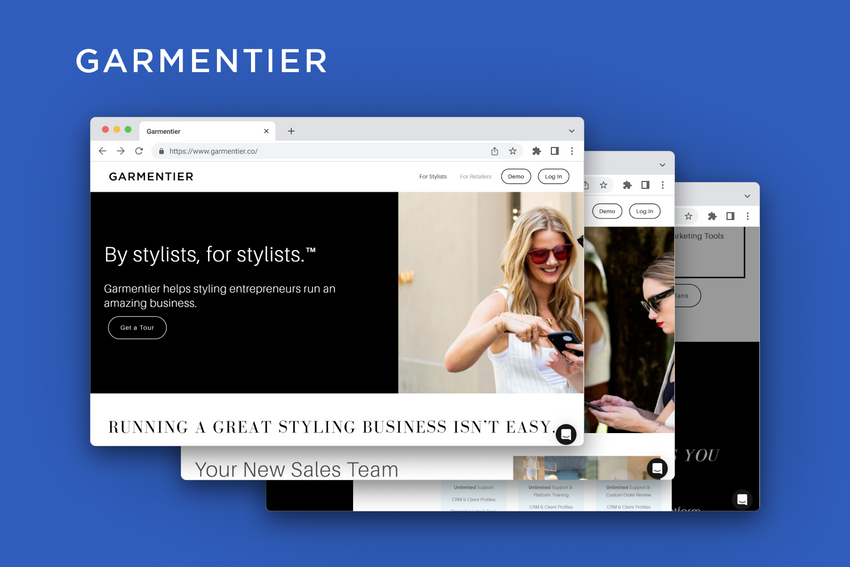

Crowdfunding is one of the great ideas for FinTech startups that will not only become the source of your revenue but will also help other people raise money and promote their products. You can build an app for non-profit organizations only, or, for example, for young artists.

Enhance it with several payment gateways and QR scanners to make it easier for investors to pay. By the way, why not gamify the process and incentivize people to fund others with a competition game, awards, or access to other useful services your business or partners can provide.

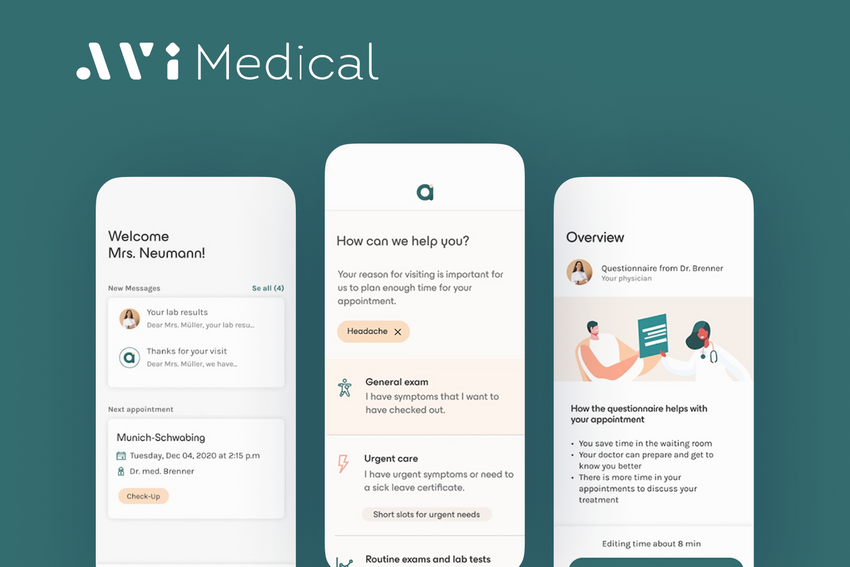

Bill reminder apps

The main aim of FinTech application development is to find a way to delegate yet another burdensome task to a computer. Here are only a few functions your bill reminder can have:

- relieve people from the anxiety of missing the due date of a bill;

- notify clients several days prior to the payment;

- automatically pay the bills;

- save a set amount each month so that a client doesn’t spend them inadvertently.

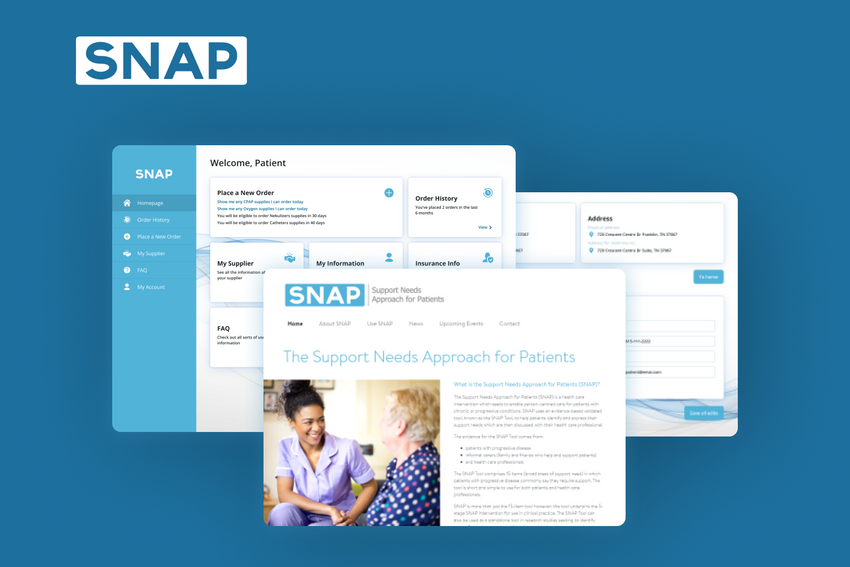

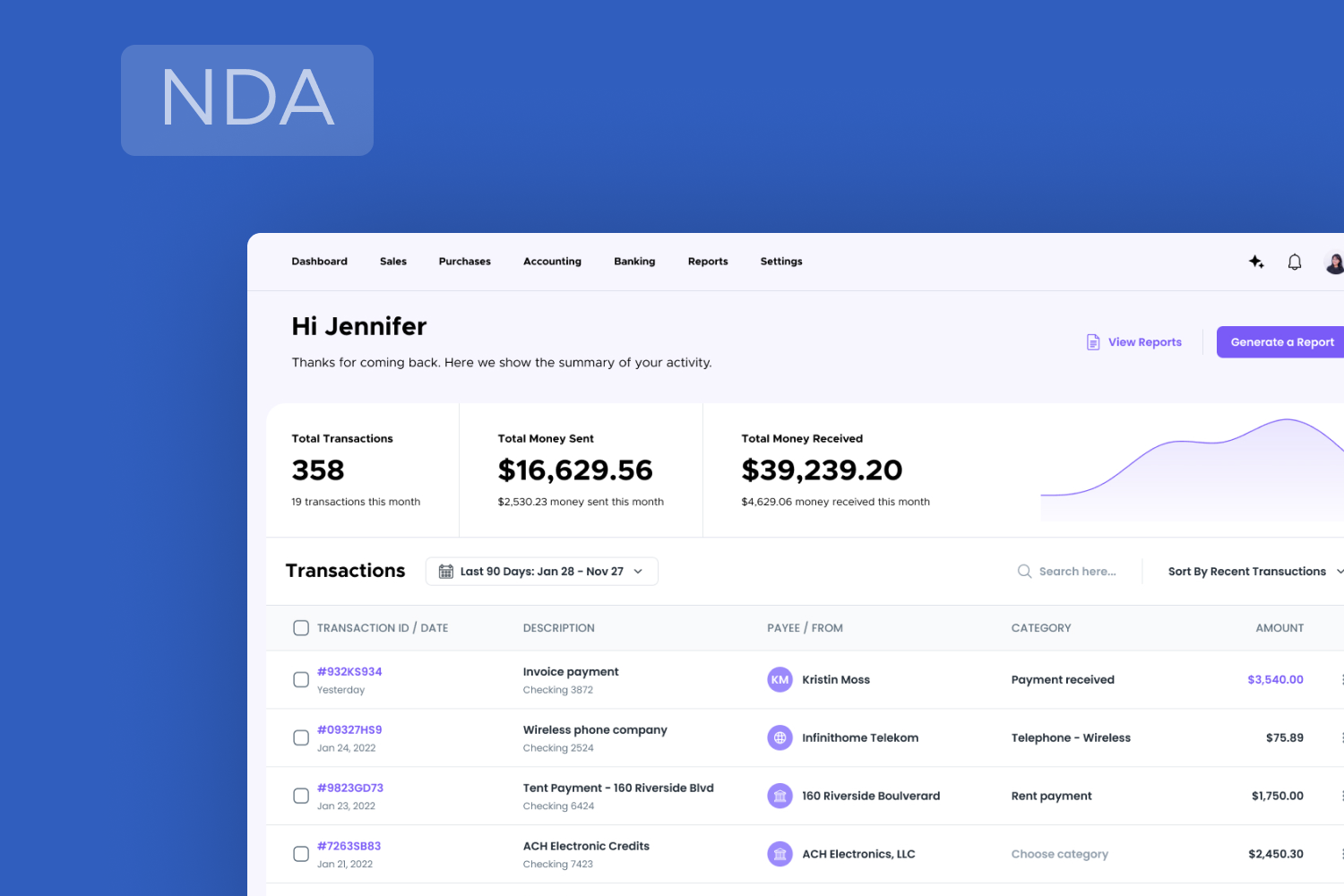

RegTech apps

If the previous finance app ideas were mainly targeted at individual users, the audience of Regulatory Technology, or RegTech, is businesses. You can work out the best one by analyzing the workflow inside your company and focusing on the steps that can be simplified.

Lots of businesses crave a robust accounting system that would create financial reports, present them in a visually pleasing form, process bills, and track cash flow without the need for human intervention. In a nutshell, you can develop a RegTech app for:

- Regulatory reporting

to manage large amounts of data and automate regulatory compliance processes;

- Risk management

to identify, mitigate, and analyze every possible risk;

- Identity management

to verify the identity of every client and confirm the authenticity of their documents;

- Transaction monitoring

to prevent money laundering and detect dubious operations.

Cryptocurrency apps

Today, cryptocurrency accounts for $1.07 billion worth of current market cap, and with its ebbs and flows, it continues to be an important player in the financial industry.

That’s why every advanced entrepreneur involved in eCommerce integrates the crypto payment gateway to allow clients to buy anything from groceries to a website subscription.

Cryptocurrency value tracking and trading is another FinTech startup idea you can realize. You may also concentrate on Bitcoin or Ethereum to tap into a narrower niche.

Money Saving App

This FinTech startup idea can be molded into so many forms that it’s only limited by your imagination and financial capacity. For example, what about an app that would save or invest 1% of every purchase, generating clients' passive income?

You can enhance it with a smart virtual assistant that’ll give people personalized advice on the most lucrative investments or ways to cut spending. Here, the gamification feature would be especially effective, as the easier your clients save their finances, the more grateful they will be to you, which will eventually lead to users' trust and hence the growth of your enterprise.

How to Develop a Fintech App in 6 Steps

The FinTech application development process is usually split into the following steps:

- Market research and idea creation.

- Hiring a FinTech app development company or a team of freelancers;

- MVP (Minimum Viable Product) building and evaluation of your idea’s feasibility;

- UX/UI development of a fully-fledged app;

- Quality Assurance procedures;

- Launching, maintaining, and updating an app.

The best FinTech startups start with a bright idea. You can get inspired by walking in the park, having encountered an inconvenience in your daily life, or reading an article on web development trends. This lightbulb moment can visit you at any time; just give it enough time and dedication.

And when it’s finally here, schedule a call with us to discuss Fively’s FinTech app development services that can benefit your business and work out a detailed plan for thriving in the FinTech market.

Need Help With A Project?

Drop us a line, let’s arrange a discussion