Credit Card Fraud Detection in Python

Take a look at our detailed guide to credit card fraud detection in Python.

An average business loses not less than 5% of its annual profits to fraud, according to a survey of Certified Fraud Examiners (CFEs), and this number is likely to keep growing if companies don’t take precautions.

Luckily, these days IT specialists can detect fraudulent transactions with the help of various techniques, such as fraud detection in Python, applying Machine Learning (ML) to analyze huge datasets, and other tools.

We will explain how we use Python to distinguish between fraud vs non-fraud.

Fraud Scenarios for Detection

What is fraud detection? It is a collection of strategies, processes, methods, and techniques we use to identify unauthorized activity and prevent money or property from being taken by scammers.

According to this research by Statista, most companies use Card Verification Number (54%) and email (43%) for online fraud detection. Customer order history is another popular asset (38%), and this is where Machine Learning algorithms come in handy. ML helps process large sets of data with many variables finding unobvious correlations between normal user behavior and possible fraudulent activity.

E-commerce, MedTechand FinTech companies opt for maximum security, which can be enabled by Machine Learning algorithms that help with credit card fraud detection in Python.

How exactly does it work? How do you detect fraud in online transactions? There is a wide selection of methods in ML for that. For example, here is a brief list of cases we have dealt with:

1. Solutions for the insurance industry

- Fake claims

- Duplicated claims

- Overstated repair cost

2. Healthcare insurance solutions

- Medical receipts and bills

- ID verification

3. E-commerce web portals and marketplaces

- Fraud in online orders

- Identity theft

4. Banking and credit cards

- Account theft and suspicious transactions

- Data credibility assessment

- Duplicate transactions

All in all, various businesses hire professionals that can provide fraud detection with Python. Data science specialists use ML algorithms to go through huge amounts of data as quickly as possible and discover suspicious actions on time. Let’s see how it works by using a credit card company as an example.

Classification as a Fraud Detection Model (Python)

Some of the common cases that we have dealt with are potential credit card scams. This is important both for companies to not lose any money and for customers to not get charged for something they didn’t actually buy.

Let’s imagine we have a dataset with hundreds of thousands of transactions. Our task is to differentiate between the right ones and the suspicious ones, so we start a long process called credit card fraud detection in Python. Cracking this case, we make classification models.

Why did we choose a classification model to discover fraud with Python? This method allows you to predict discrete variables such as true/false, yes/no, safe/fraud, etc.

Fraud detection with Python is considered to be a highly effective tool. Why? There is a bunch of reasons:

- Python is among the most popular languages, loved by both developers and entrepreneurs

- It is relatively easy to learn, and a vast community is always here to help

- It supports lots of ML packages that enable a higher accuracy

- It’s effective for credit card fraud detection: Python uses a wide selection of tools to speed up complicated processes and make the right decision on time

Working on the credit card fraud detection project in Python, we will go through several steps:

- Importing and preparing the data

- Processing the data with Exploratory Data Analysis (EDA)

- Splitting the data and fitting the model

- Building 6 classification models

- Checking our models with the help of 3 metrics

With that, let’s dive in, describing the process in detail and making code examples.

Preparing the Data for Fraud Detection in Python

We start with reading the source data, studying the variables, and examining some samples. Our goal is to understand various columns of data, their features, and other necessary information.

Packages and libraries we normally use for a credit card fraud detection project in Python:

- Pandas

- NumPy

- Scikit-learn

- XGBoost

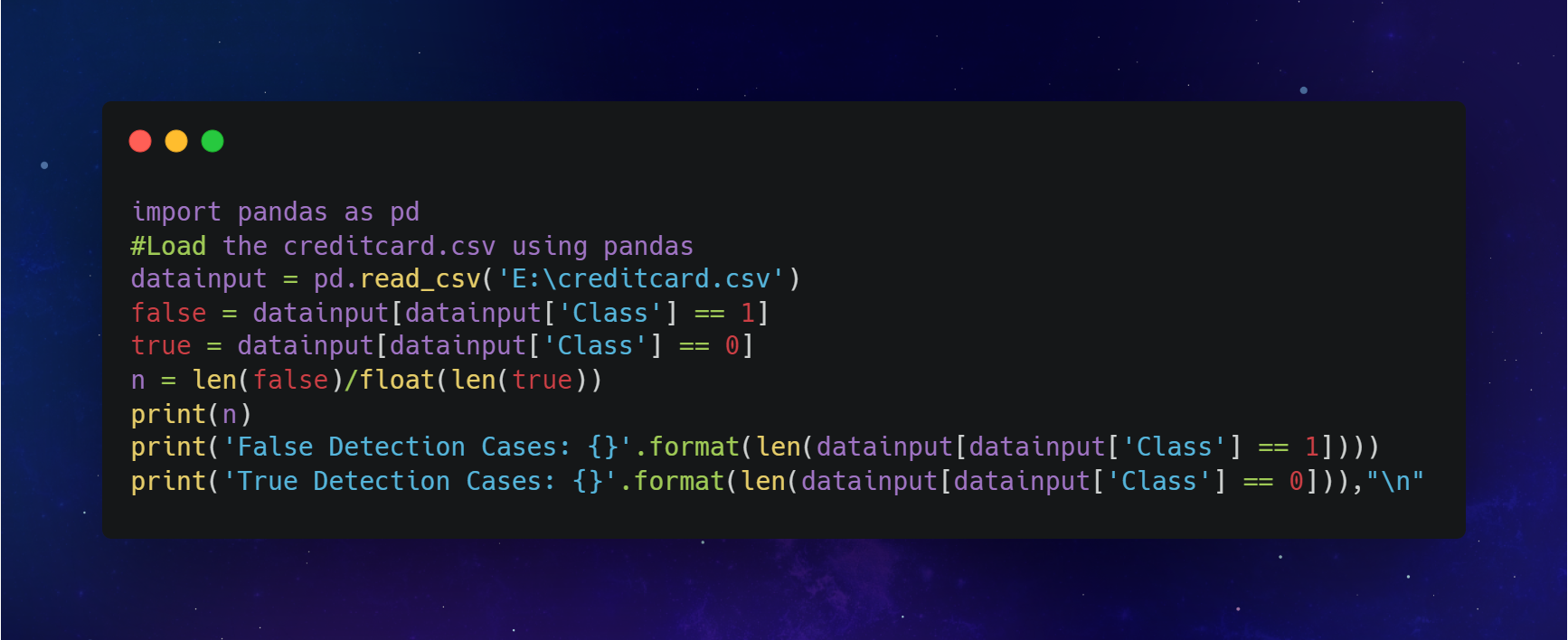

Let’s begin. We will apply Pandas to create a specific data frame for continuous use.

Example in Python

Our next steps will include further processing of transaction data, including the method called Exploratory Data Analysis or EDA.

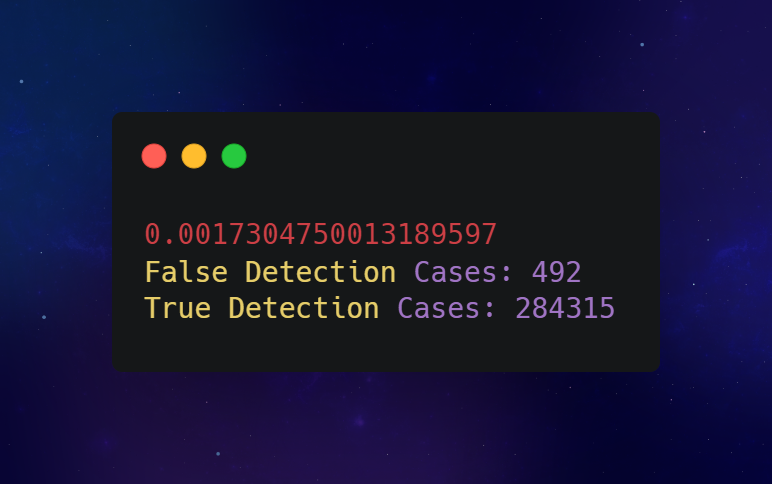

We determine how many fraud and non-fraud actions there are. Running the Python code, we receive our first result.

Example in Python

Result of fraud detection (Machine Learning, Python)

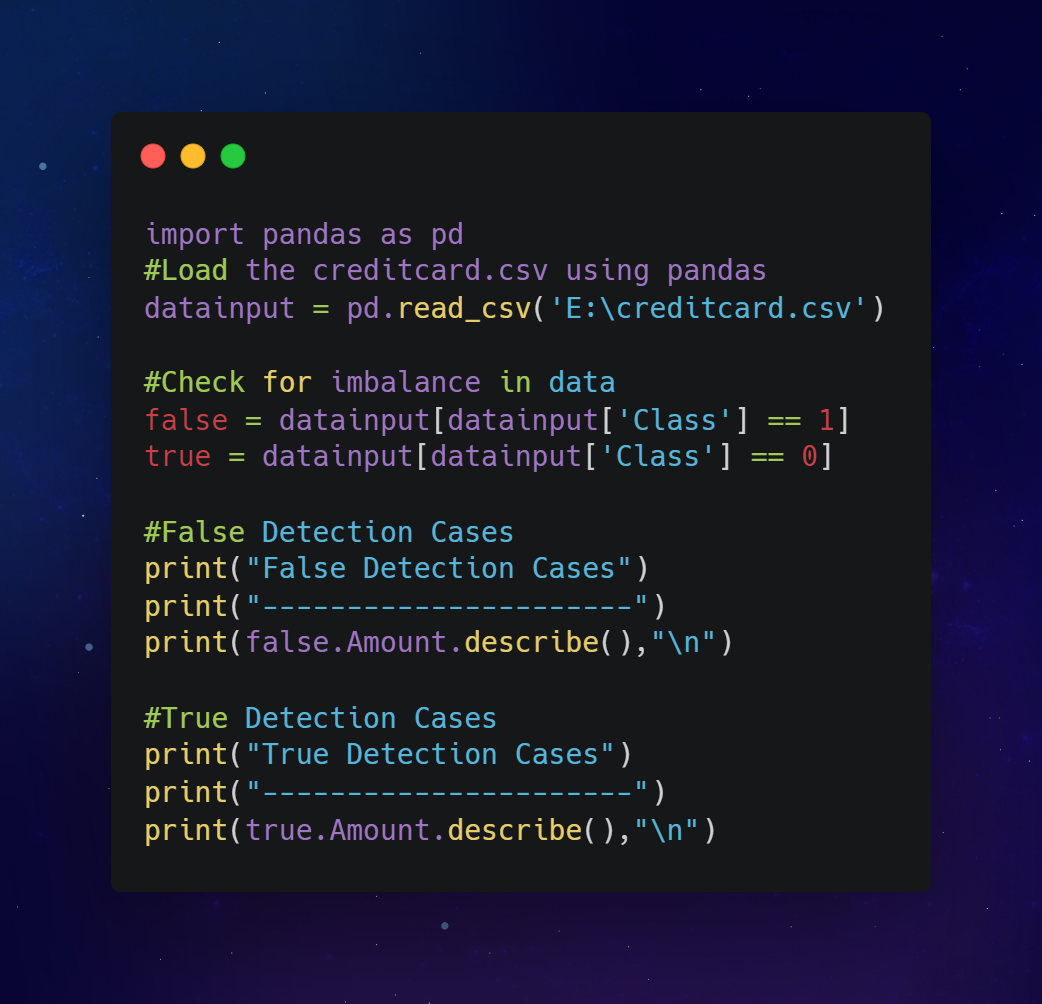

Next step – we investigate all the details about fraudulent transactions and non-fraudulent ones. What interest us here is a statistical picture that includes parameters like:

- Maximum value

- Minimum value

- Standard deviation of the mean

- Various percentiles

Using the method called ‘describe’, we find all of it with Python: fraud detection examples typically include all the statistics.

Example in Python

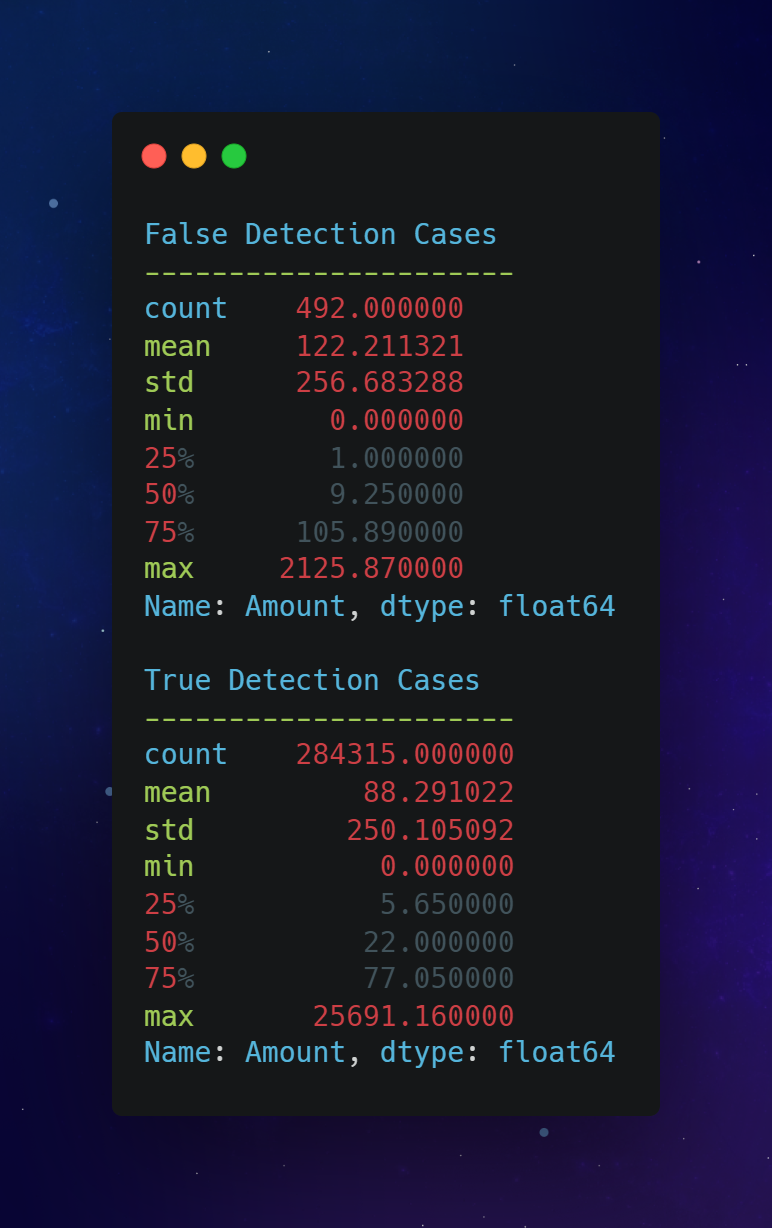

Result of analysis for fraud detection (Machine Learning, Python)

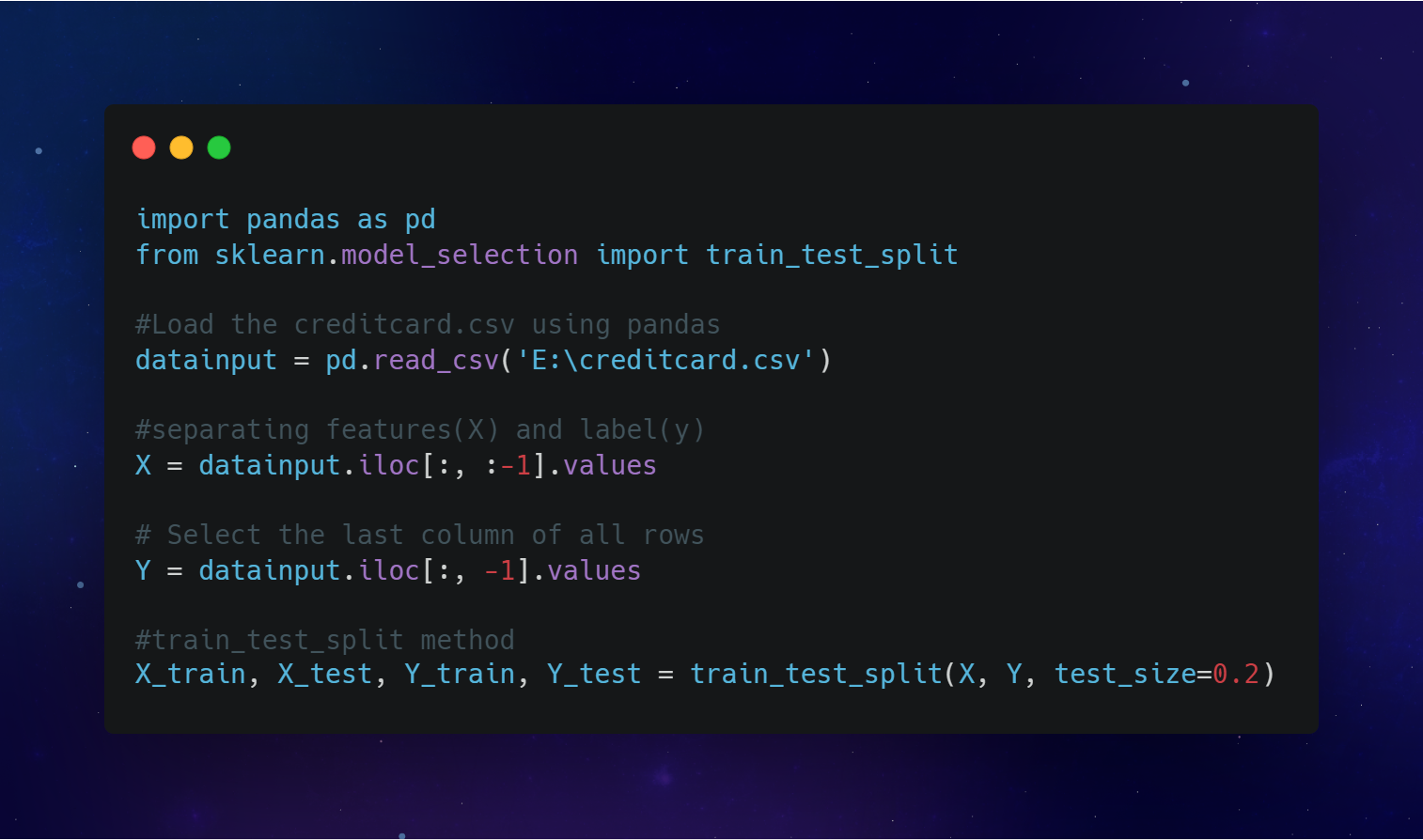

What we do next is called data split: defining two kinds of variables: dependent (Y) and independent (X). It is also called the ‘split x y test’ in data science.

Defined variables will help us split the data into two sets:

- Test data

- Training data

We will use the two sets to make a fraud detection model (Python) and evaluate the final results. In coding, we apply the ‘train_test_split’ algorithm to split the data efficiently.

Example in Python

The ‘split x y test’ is one of the vital procedures in ML.

‘Random state’ is a hyperparameter we use with the function train_test_split() to shuffle the data before splitting.

Test_size is a parameter to determine what percentage of the data we will use for testing.

Now we have two sets as a result of the division of our initial dataset for fraud detection: machine learning (Python) allows us to split the data quickly and successfully.

As we got all the necessary components, we can proceed to building and training the model.

Need Help With A Project?

Drop us a line, let’s arrange a discussion

How we Build and Train Fraud Detection Model (Python)

In the previous step, we split the data set into two parts: test data and training data. As their names suggest, we use the first one to test the result while the second one is for training the model.

Fraud detection using Python enables us to apply the classification method and build different models. In the end, we will choose the ones that give the most accurate predictions.

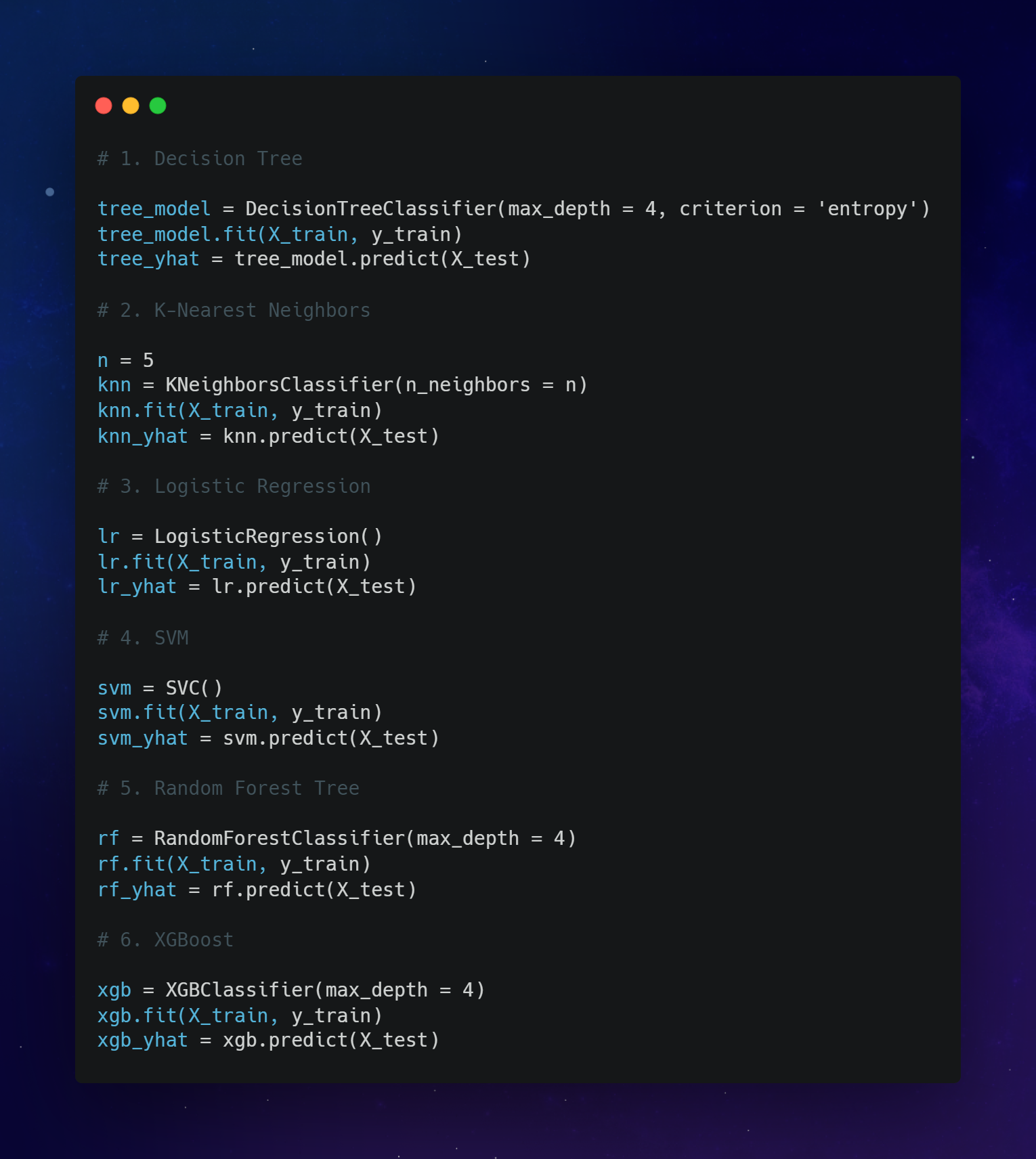

6 classification models include:

- K-Nearest Neighbors (KNN)

- Logistic Regression

- Support Vector Machine (SVM)

- Random Forests

- XGBoost

- Decision Tree

Building the first five models, we apply an open-source library Scikit-learn. As for the XGBoost fraud detection model, Python supports the XGBoost package.

This is how we do the modeling.

Example in Python

Now when we have all 6 models, it’s time to evaluate each of them. It is time to decide which model will prove to be useful when we detect fraud in online orders and credit card payments.

Evaluation for Python Fraud Detection: Example from our Experience

Having built the models, we start evaluating. But first, let’s define two important ML terms.

- True positives are results of predicting the positive class when a model does it correctly.

- False positives are results of predicting the positive class incorrectly.

We use both true and false positives to analyze datasets and detect fraudulent actions with Python.

After building 6 models that can recognize fraud using Python, it is vital to evaluate their quality.

We usually apply these three evaluation methods:

- Accuracy score

- F1_score y test

- Decision tree

- Confusion matrix

Given the fact that our case is credit card fraud detection, machine learning (Python) can give us exhausting answers about any suspicious transaction.

Accuracy score is a simple and basic evaluation metric for classification models in Machine Learning.

Accuracy score = Number of correct predictions / Total number of predictions

How do you express it in percentages? Just multiply by 100.

F1 Score is a popular metric for evaluation in ML. It is deeply connected to metrics like recall and precision, representing the balance.

F1 score = 2( (precision * recall) / (precision + recall) )

We can calculate the F1 score with Python using the f1_score y test provided by the Scikit-learn package.

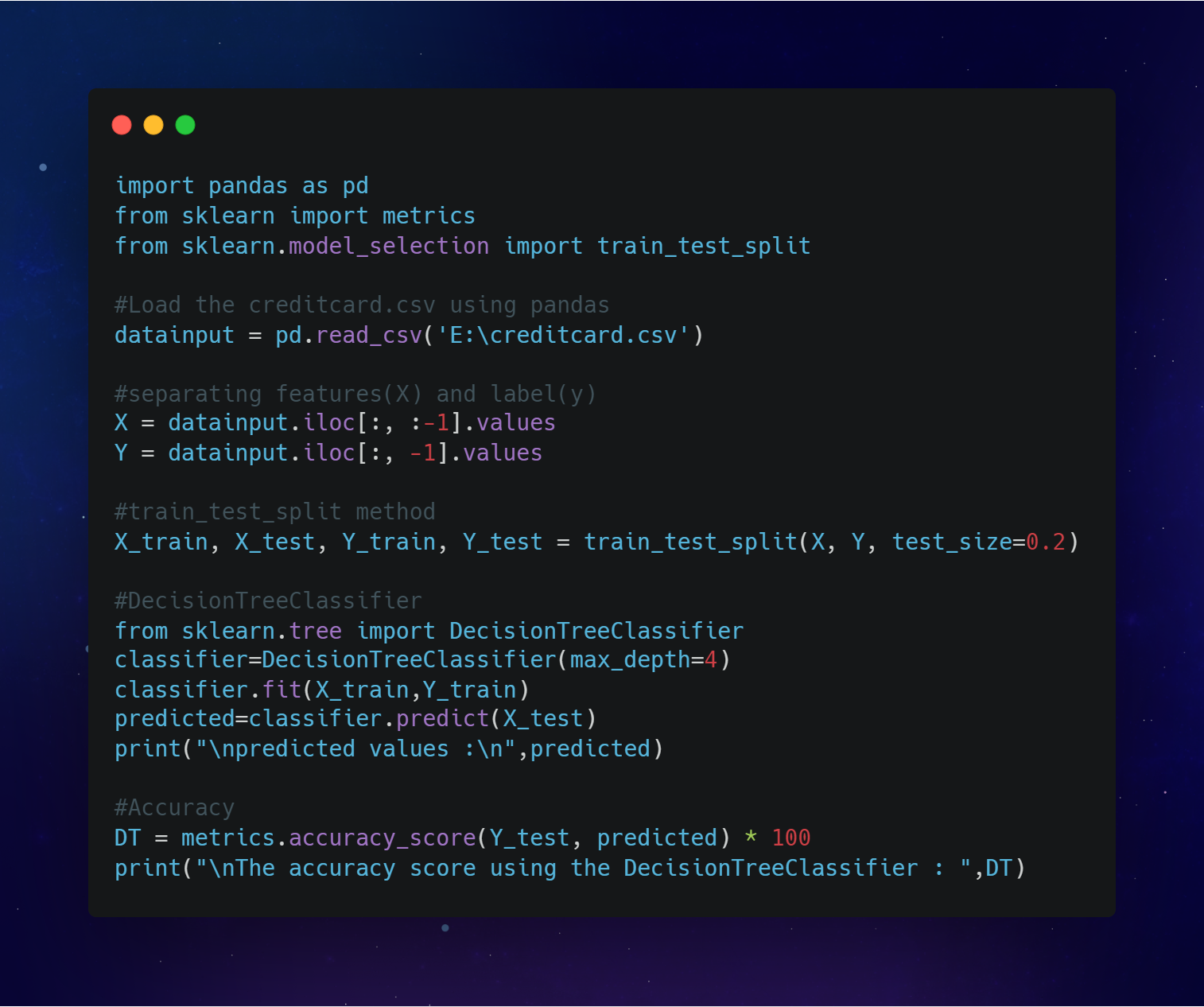

Decision tree (DT) is a powerful method to use in machine learning. One of the best things about it is that you can represent decision-making visually, like a tree with lots of branches.

Here is how we use the DT as an evaluation method in Python fraud detection: an example of the whole process.

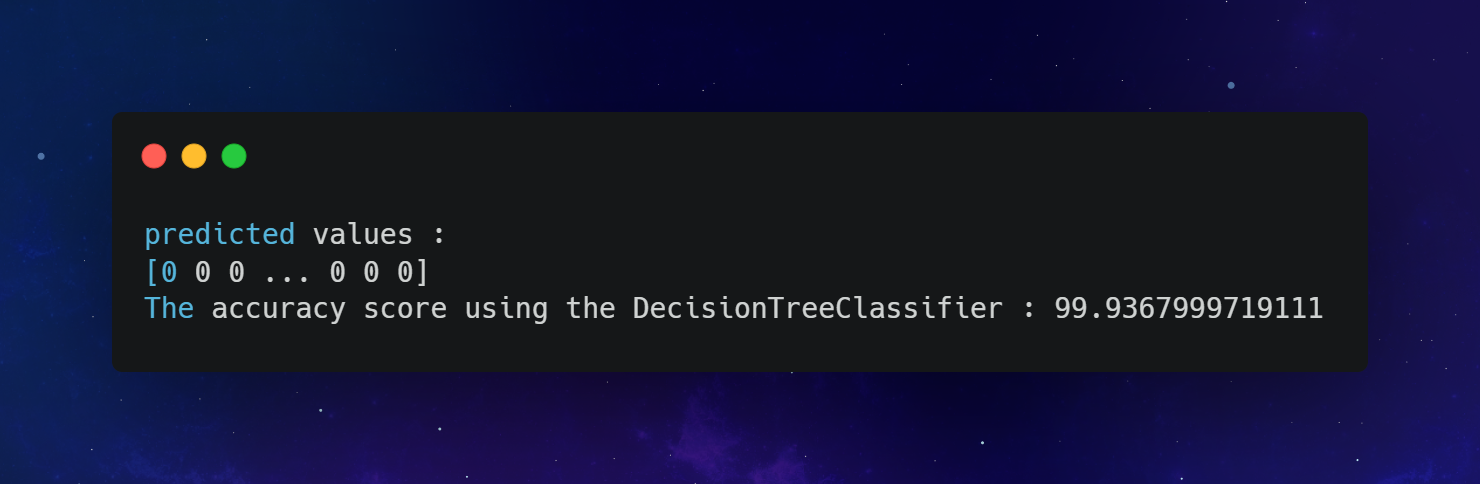

Example in Python

Result of evaluation for fraud detection (Machine Learning, Python)

Confusion Matrix is one more method to visualize the results of a classification model. We can store the predicted outcomes in a variable to convert them into a correlation table and eventually build a heatmap.

Having visualized a confusion matrix for each model, we discovered that K-Nearest Neighbors XGBoost, and Decision Tree are our best choices for fraud detection with Python in credit card transactions.

Some Other Areas of Using Python

Where do we apply Python, apart from the fraud detection projects? Almost everywhere. It is amazing how one programming language can be a solution to various kinds of problems.

Here is a brief description of what we can do with Python at Fively:

1.Python for web development: we create web-based applications from scratch.

Python supports lots of frameworks such as Flask, Django, and more. They allow creating a great user experience: take websites like Spotify and Reddit as a perfect example.

2.Python for automation: we build solutions that reduce manual work.

Python is good for automation because it’s functional and object-oriented. Our engineers can develop file management tools, automated reports, eCommerce websites, email marketing tools, and other workflow automation solutions for organizations.

3.Python for data analysis: we create features for data science software

Thanks to its simple syntax, Python is an ideal tool for data analysis, which includes many cases of application alongside finding suspicious activity. Our Python engineers can make a valuable contribution to your data analysis platform that helps answer many business questions: What happened? Why did it happen? What may happen in the future? – and many more.

4.Python for ML applications: we develop ML elements for apps

There is a wide range of Python-based features included in many projects. They can, for example, recognize images and speech, translate and summarize texts, give product recommendations, predict traffic, etc. We have also worked on projects that use virtual assistants and access control.

5.Python for project migration: we upgrade old projects to Python

Software developers at Fively use Python scripts to migrate a code base successfully to Python. This process is quite fast and very efficient.

6.Python for support and maintenance: we help increase customer satisfaction

At Fively, we never restrict our services to simply coding and engineering. We also support, update and maintain Python-powered software. Our clients understand that even the most advanced technology has glitches and issues. These are just things that happen, and our developers help to illuminate the problems. In many cases, we discover an issue before you notice.

There are many types of projects that we implement with the help of Python. For example, our software engineers provide custom Python software development to create intelligent chatbots for any business. Since the pandemic, we have enabled IT modernization for a number of remote workplaces.

Today, we build solutions for each and every industry, including:

- eCommerce business apps and ERP

- Task management apps for enterprises

- Blockchain and cryptocurrency apps

- Data visualization & search platforms

- Social media and entertainment apps

- E-Learning web apps

- Booking apps

- Data protection and security apps

Now let’s go back to data analysis with Python and discover some difficulties of using it. We will also look at the bright side and name many advantages that modern enterprises can have with this technology.

Machine Learning for Fraud Detection: Pros and Cons

There are both advantages and challenges to using ML and Python for fraud detection.

Advantages:

- Compatibility with other types of technology. A quick example is DPAPI or data protection API (Python), a programming interface used with Python to handle credentials and other sensitive data. This piece of technology can be beneficial, for instance, in a custom CRM for business.

- Unbiased analysis when it comes to machine learning. Algorithms simply analyze data without making assumptions.

- Time-saver that allows humans to focus on difficult and creative assignments. As a result, all work processes become more productive.

- Fast data processing with ML systems. They don't just reduce manual work, human error, and bias – they also make processes easier and improve the user experience. Combined with cutting-edge behavior analytics, machine learning algorithms make verification simpler, reducing the number of steps.

These were the pros. What about fraud detection cons? We can name a few, too.

Challenges:

- Good and vast data is required. When it comes to machine learning fraud detection, Python is a perfect tool that should have enough data to work with. If not, your datasets won’t be statistically relevant.

- Advanced technical expertise. Data scientists should have an in-depth understanding of how payment fraud works and how to use Python for fraud detection.

- High cost of development. If a company builds a fraud detection tool in-house, they need a whole team of data scientists to build and update the system. Besides, businesses invest in proper storage and management of huge amounts of data.

Speaking about budgets – how much does fraud detection software cost exactly? In short, it depends on the features that you are looking for. Let’s talk about it a bit.

Fraud Detection Software: Features and Cost

When it comes to fraud detection tools, we recommend you to use the same approach as with other custom software development solutions: decide what kind of functionality you need urgently and what features can wait.

The list of features of online fraud detection software typically includes:

- Real-time monitoring of various sources: databases, transactions, events, employee and customer activity

- Custom settings: creating business-specific parameters to prevent potentially fraudulent actions

- Transaction screening and reviewing in real time

- Detection of certain patterns and anomalies

- Role-based access for all users to prevent unauthorized actions

In a nutshell, creating a fraud detection platform is quite similar to custom CRM software development and ERP application development.

How much does fraud detection software cost? Off-the-shelf SaaS solutions have basic plans ranging from $25 to $1,000 a month. All in all, you will have to pay from $300 to $12000 yearly.

Vendors typically base their pricing on the number of:

- transactions

- queries

- rules (of validation or grouping)

- features

Plans with a high level of customer support may cost from $1250 a month. Some enterprises require a quote for the fraud detection software.

Although off-the-shelf software is a decent choice in many cases, there are some cons that may need serious consideration.

Potential drawbacks include:

- Limited customization: ready-made solutions may simply not have all the features you want.

- Lack of flexibility: a vendor may change some functionality, and you cannot do anything about it.

- Additional costs: in most cases, you pay more as your database grows.

If you are looking for a solution that enables fraud detection with Python and machine learning algorithms, in many cases it’s worth building a custom in-house solution to save the budget in the long run. Alternatively, you can purchase a ready-made solution and tailor it to your needs with the help of skilled data scientists.

Wrapping Up

We have talked about various scenarios of fraudulent actions online, discovered the whole process of fraud detection using Python and machine learning, and reviewed some vital features of such software solutions.

Python developers at Fively have contributed to a number of projects with machine learning. Besides that, we have build web-based Python solutions from scratch, provided migration to Python, and maintained Python-powered software.

Fively is here to help your business get the most out of advanced IT technology, so don’t hesitate to get in touch with us.

Need Help With A Project?

Drop us a line, let’s arrange a discussion