Cutting Edge Technology 2026 in Software Engineering

The article discloses the latest high-tech solutions in custom software engineering that Fively recommends to advance and innovate your business in the upcoming year.

Building custom software development solutions, our specialists implement all the breakthroughs and best practices from the world of engineering. First, Fively software specialists test them, then we give them a go, and if they lead to a better result, we start to use them regularly. Today we will tell you about cutting-edge technology 2026 we at Fively use to build smart, scalable, and secure software solutions for your business.

What is New Cutting-Edge Technology?

Cutting-edge technology (also known as leading-edge or state-of-the-art technology) refers to technological solutions, machines, devices, services, techniques, or achievements that employ the most current and high-level IT developments. New cutting-edge technology helps the leading and innovative IT industry organizations to come to business, technological, and programming breakthroughs.

Examples of New Cutting-Edge Technologies

Let’s look at some examples of cutting-edge technology and see how they benefit companies in various industries.

By now, AI, ML, AR, and VR technologies are widely used in such niches as entertainment, medicine, banking and finance, automotive, repair and maintenance, quality assurance, design and assembly, immersive training, car, and airplane simulators:

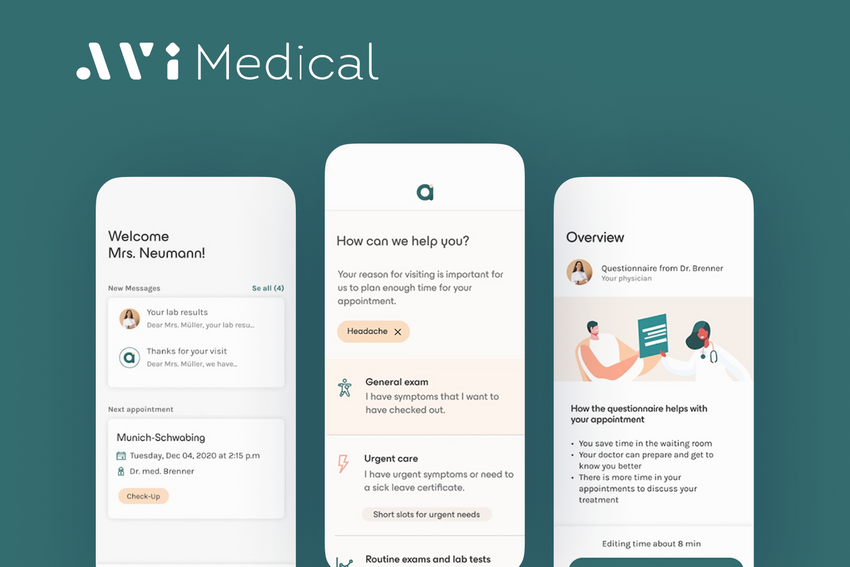

- In healthcare, AI helps to increase clinical efficiency and accuracy, boost diagnosis speed, improve patient outcomes, and facilitate recovery with precision medicine and robotics surgery. It also helps to get rid of the long queues to the doctor and monotonous paperwork thanks to chatbots and NLP applications able to understand and classify clinical documentation;

- In telecommunications, the latest software technologies implied in self-optimizing networks (SONs) like Netflix allow gaining insight into customer behavior predicting industry trends, improving and specifying customer experiences, and optimizing 5G network performance. Experts at McKinsey say that about 66% of telco organizations expect to integrate AI and ML into their processes within the next two years, compared to only 37% in 2021.

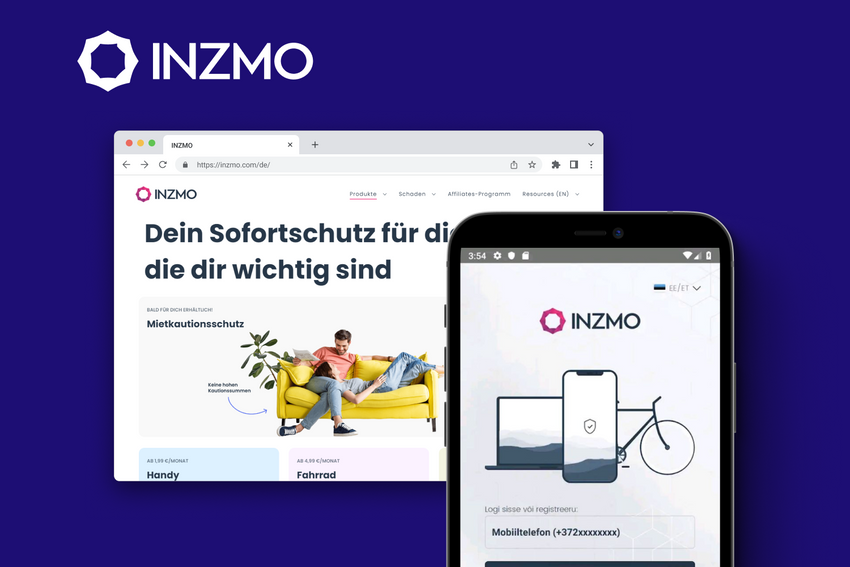

- Insurance and financial companies use AI and ML-based chatbots and workflow automation solutions to digitalize their claims processing, personalize customers’ experience and create user-based insurance services, improve risk analysis, and better detect fraud and money laundering, which altogether helps to differentiate their services in a broad marketplace.

- The automotive industry has transformed greatly in the past few years thanks to AI and ML adoption across the industry. Combined with the implementation of electric and autonomous vehicles, and predictive maintenance models, this industry has now far better KPIs, operational outcomes, and overall profitability than even 5 years ago with Tesla as a key player.

- The energy sector adopted AI and ML cutting-edge technologies together with the new ways of producing, storing, delivering, and using energy changing. This has also happened due to global climate concerns, changed market drivers, and significant technological advancements. Now energy companies from all over the world use AI and ML for developing intelligent power plants, shortening consumption and costs, developing predictive maintenance models, optimizing field operations, as well as improving energy trading.

Single-Tenant Cloud Solutions

Speaking about the hottest tech trends, the first place Fively will give to the use of single-tenancy, which we will implement in our SaaS (software-as-a-service) software delivery models. It is a cutting-edge cloud architecture of 2026 in which a single instance of a software application and supporting infrastructure serves only one customer (tenant). Here the hosting provider aids in managing the software instance, lending nearly full control to a single tenant at the same time. Thus, each piece of software may be purpose-built for the new tenant, and after the software is installed locally, tenants can typically customize the software to best suit what is needed for their environment.

The use of single-tenancy models has the following advantages:

- a higher level of user engagement and control

Single-tenant instances have proved to be more transparent and reliable, since performance is based on only one instance, instead of many from different tenants;

- more flexibility in addressing specific requirements

With this latest cutting-edge technology, all of a customer's data is separate, and a large degree of customization is possible for software and hardware instances;

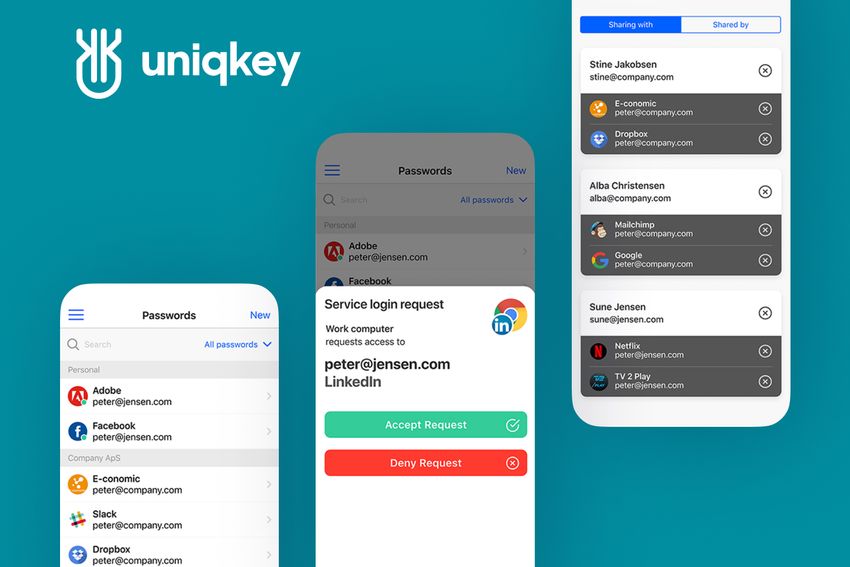

- increased security due to independent data storage

Data is independent of other potential tenants with the same provider. Even if there is a data breach to one tenant with the same service provider, another tenant would be safe from the breach since data is stored in a separate instance;

- easy operability and backup ability

Isolated backups allow users to quickly enable recovery if there is a disaster and data is lost. Single-tenancy may also lend itself to migrating from a host environment if needed.

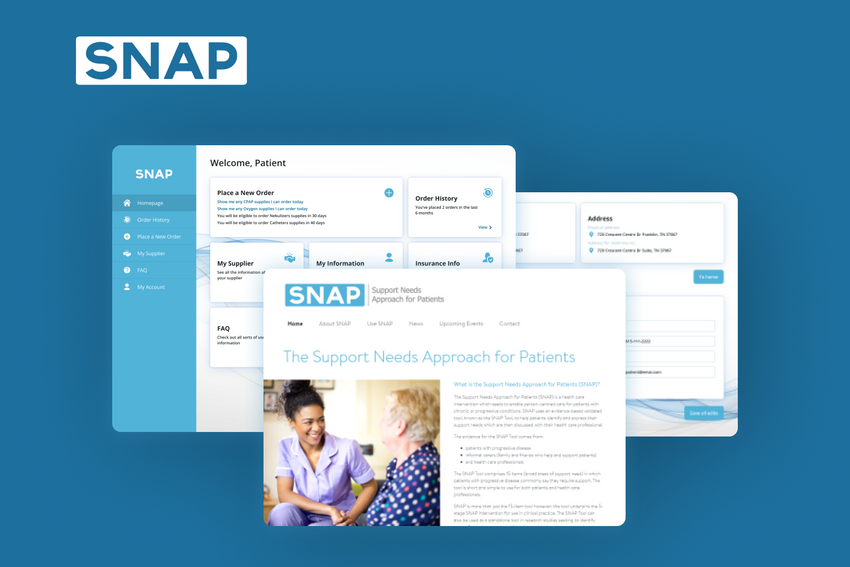

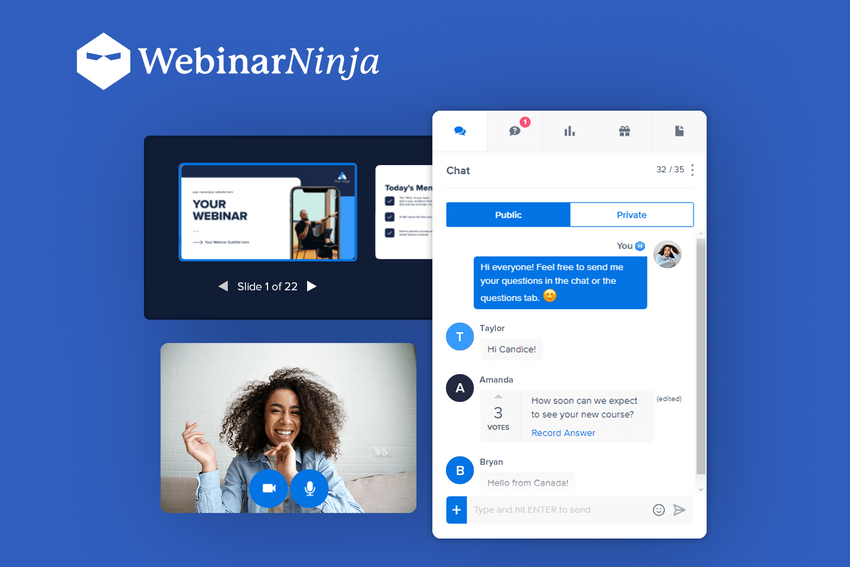

Remote Work Applications Development

With numerous travel bans and other restrictions related to the COVID-19 pandemic, it’s becoming more difficult for business owners to maintain processes at remote locations all over the world. Remote work application development is our cutting-edge technology that successfully solves this problem: it allows all the company’s personnel to operate at the needed location staying at HQ, and advise colleagues, partners, or customer personnel onsite. This technology not only provides you with a complete view of the service activities but also allows you to fully guide the on-premise resources and services.

The advantages of using Fively remote work application solutions are:

- high-quality service in a shorter period

A team from HQ operates with customers at your remote location in free-flowing, productive meetings powered by high-definition video calling, crisp audio, and full-featured collaboration tools so they complete entire interviews and transactions as if your customers and staff met in the same room;

- enhanced collaboration between all stakeholders

With the use of the latest cutting-edge technology in our remote work applications, we provide a full spectrum of internal and external communication capabilities: dynamic content, touchscreen displays, HD video, and intelligent telephony;

- the virtual flexible pool of workers

Creating a virtual pool of experts is the newest cutting-edge business technology. No matter where they are located — in specific centers, dispersed within your network, or located at home — for instant access to knowledge workers who can help maximize sales opportunities;

- simplified multichannel delivery and accessibility

Instantly identify and connect with the right domain experts so they can personally share knowledge with internal and external customers in business-to-business and business-to-customer scenarios.

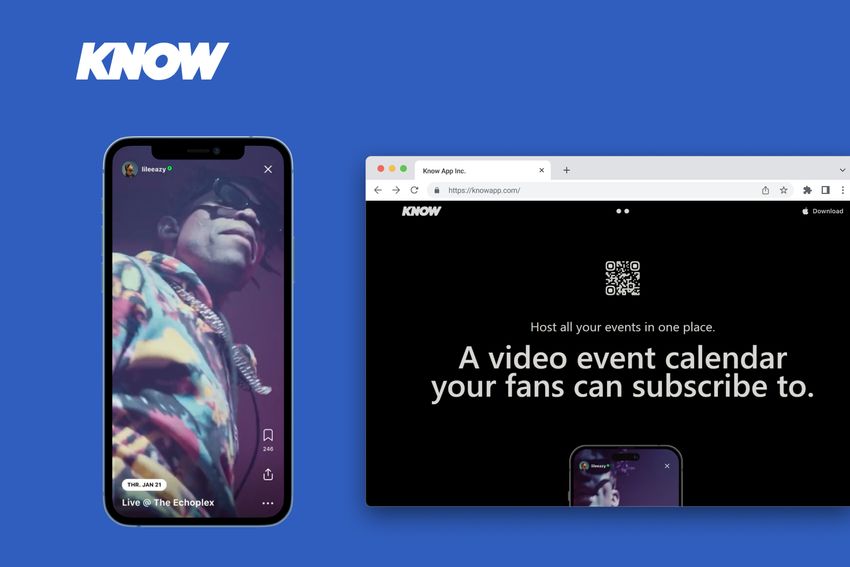

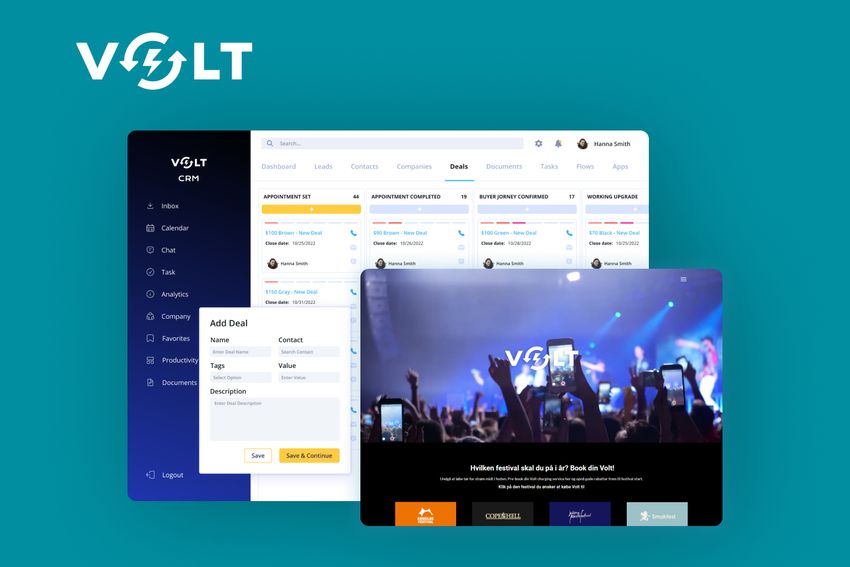

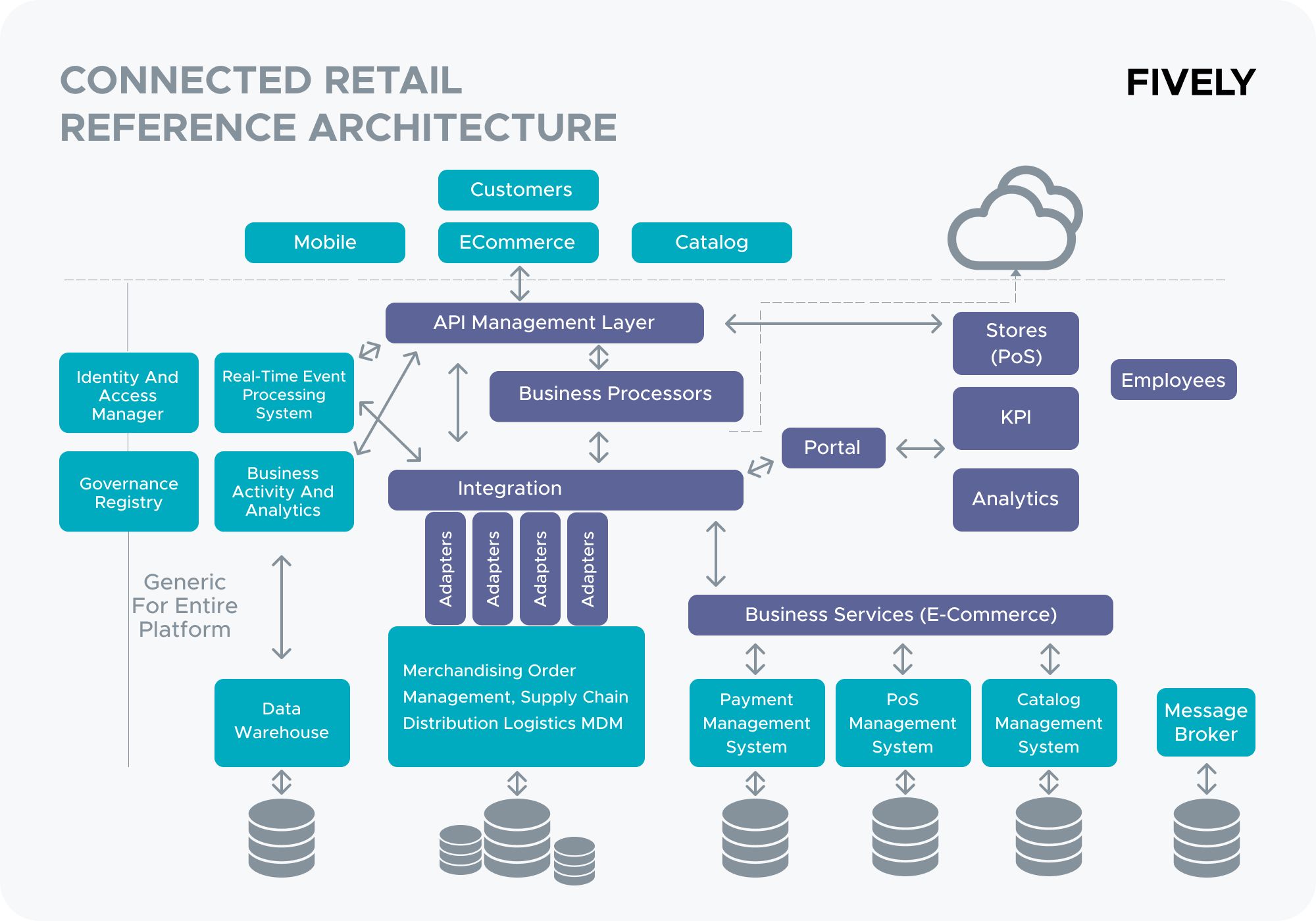

Marketplace and Collaboration Platforms Development

Fively software specialists implement the latest cutting-edge technologies to achieve better results for our customers, and multichannel e-commerce marketplace development will definitely be one of the hottest tech trends in 2026. They allow us to greatly optimize team operations through interconnected applications and web services across all business segments. Plus they help to collaborate with like-minded marketplaces, create common products with wider options or certain offers of limited edition, diversify your product portfolio, and build a strong business community.

Implementation of customized marketplace solutions lead to the following results for a customer:

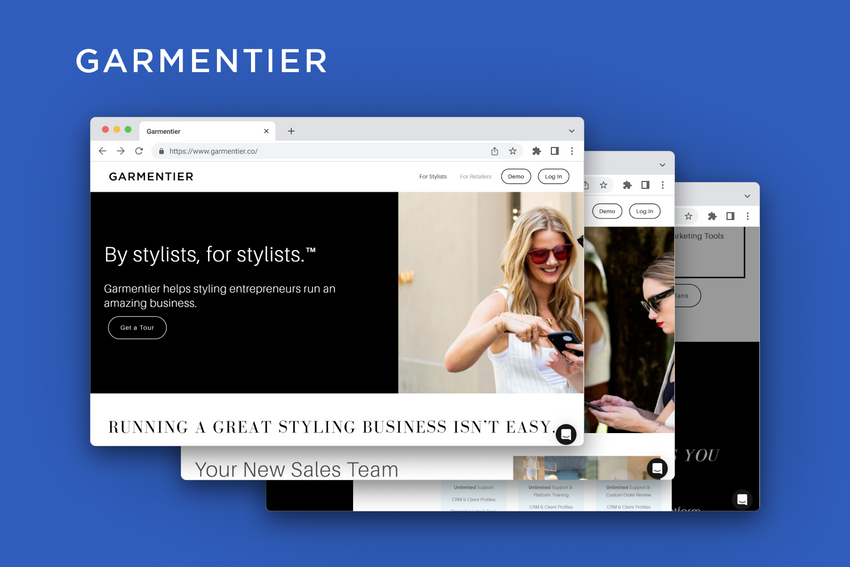

- get a highly tailored business and niche solution

Prior to the development stage, we provide expert strategic consultancy on marketplace and collaboration development to achieve strategic marketplace business goals, widen your operational reach, and increase profits;

- seamlessly manage and optimize complex workflows

We create collaborative, partner management, and inter-business process management platforms, using the most cutting-edge technology to re-engineer legacy applications, restructure business processes, and improve your overall productivity;

- link all your applications to facilitate access to crucial enterprise information

Fively covers all aspects of portal development with third-party integration to make it operable and flexible;

- dive into the immersive virtual experience

With this modern platform, you can send, store, and archive high-quality audio and video messages to consistently deliver the needed information and raise the customer experience.

AI and ML

Artificial intelligence (AI) together with its subsets machine learning (ML) and deep learning (DL) allows the creation of sophisticated algorithms able to simulate human intelligence and behavior patterns, including perception, learning, and problem-solving abilities with the use of suitable programming languages and algorithms.

The range of our AI-based solutions includes modern web search engines, personal assistant programs that understand spoken language, self-driving vehicles, as well as recommendation engines, such as those used by YouTube.

We believe that using AI, ML, and deep learning cutting-edge technologies has the potential to transform all aspects of a business by helping them achieve measurable outcomes including:

- increase your customers’ satisfaction

The use of AI and ML allows you to save customers' time, build trust in your brand, and highly differentiate your solutions;

- automate business operations and reduce costs

Automate repetitive tasks and analyze diverse data on your performance, ROI and KPIs, defying the departments and branches that leg behind;

- get insightful analytics and increase revenue

Discover visualized customers’ preferences and dislikes, structured by age, location, gender, etc., in real-time, as well as define the upcoming trends and tendencies based on the info gathered.

AR and VR

VR (Virtual Reality) is a digital environment generated by a machine, in most cases implemented as a head-mounted device (HMD), while AR (Augmented Reality) only “augments” the real-world experience with the help of cutting-edge software in the form of text, graphics, audio, and other virtual forms onto the physical environment, just like we can see in smartphones, tablets, and smart glasses.

According to the research by Capgemini, 75% of organizations with large-scale VR and AR implementations including giants such as Boeing, Siemens, and Volkswagen realized over 10% operational benefits. These companies are real giants, so if we convert this 10% to US dollars, we will get millions and even hundreds of millions.

This is possible due to such AR and VR benefits as:

- high engagement revolutionizing the ‘Try Before You Buy’ concept

This cutting-edge technology allows customers to enjoy the content in a more immersive environment, creating an emotional and perceptional connection with them, and increasing their willingness to buy the product;

- introducing products to new target audiences

With the right VR and AR cutting-edge software, the presentation of your products or services comes to a much higher level, as you can show them from all possible sides, let customers “touch” them, and create a much more interactive shopping experience;

- increasing brand awareness via shares on social media platforms

They have the personalized characteristics of social media platforms, so users can experience the content from a first-hand subjective personal perspective and even unknown brands can strongly build their online presence by harnessing the power of AR and VR;

- generating detailed analytics for understanding users' behavior

Augmented and virtual reality solutions integrate analytics of the web and social media, spotting the light onto the understanding of your users’ preferences and behavior. Once you get a deep understanding of your target audience through analytics, you will get unlimited opportunities: refine your target market, build sales strategy, reach new audiences, maintain the interest of regular customers, and much more.

Together with the development of cutting-edge software like single-tenant cloud solutions, marketplace, and collaboration platforms, remote expert solutions, etc., Fively well-structured project software teams are committed to providing high levels of support and maintenance service to our clients at all stages of the development process. We believe that close collaboration with customers, defining and closing their needs, and striving for a better result are important parts of fruitful cooperation.

Innovate your business with custom cutting-edge software development by Fively in 2026. Contact us if you need a reliable partner in the world of software engineering, we will provide you with a free technical consultation and be happy to discuss your business goals and project ideas.

Need Help With A Project?

Drop us a line, let’s arrange a discussion