Top 5 Insurance Industry Trends in 2026

Find out how the insurance industry has changed since the COVID-19 pandemic. Check out our overview of the insurance industry in 2026.

The last two years were quite challenging for the insurance domain: coronavirus, heavy workload, lack of skilled talent, constantly changing working conditions, and global trend for remote. What is happening here now and what to expect next? It's time for an insurance industry outlook! Read our overview of the top insurance industry trends gaining strength right now.

Customer-centric Approach and New Corporate Culture

Speaking of trends in insurance, the first place among the industry changes takes a completely different customer policy. According to FCA, during the coronavirus, people felt frustrated and disappointed with the extremely low level of support provided by their insurance agencies. Traditional protection policies failed to prove their value, having resulted in a loss of clients.

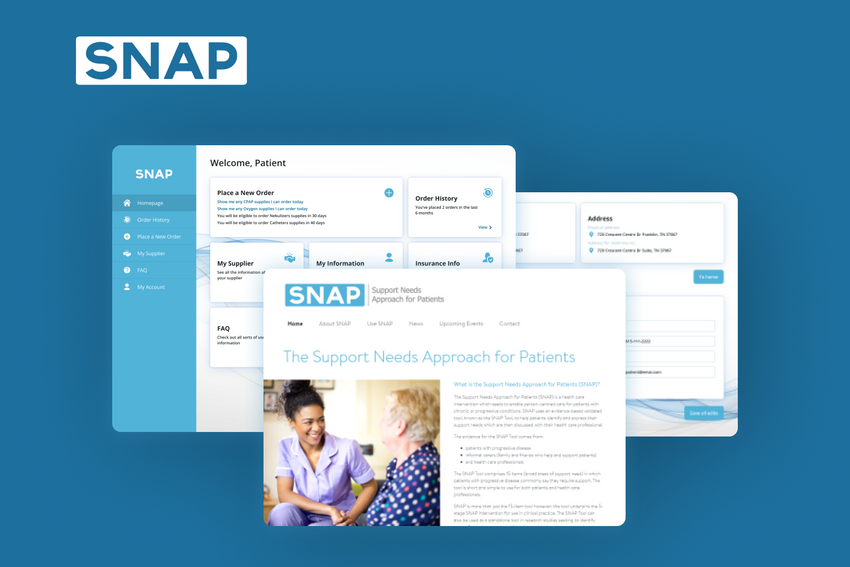

Now people want to pay for real help accessible at any healthcare center, that’s why preventative and service-based policies are in demand. That’s why insurers are trying to become customer-centric in a short time. They seek fresh blood who can think outside the box to close the gap between the market needs and agencies’ actual capabilities. Such steps lead to a brand-new face of the domain and require not only a completely different business strategy but also new technologies and management systems adoption, as well as reduction of bureaucracy and paperwork.

These steps cause great exhaustion to companies' budgets and employees, so we do not expect significant insurance industry growth in 2026. At the same time, 45% of insurance companies globally want to implement new software next year, which will result in much greater demand for hi-tech and new talents in the sector compared to pre-pandemic periods.

Digital Transformation and Legacy Modernization

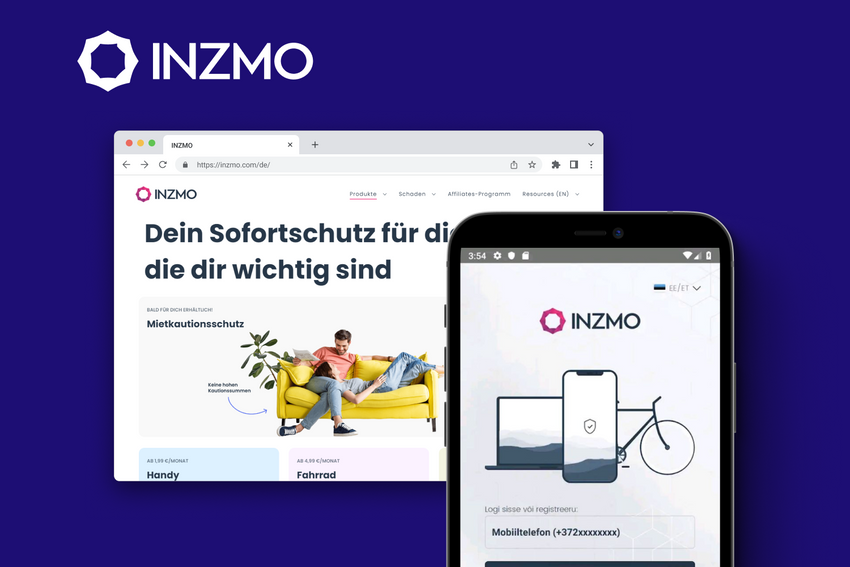

A vast percentage of insurance companies still run outdated software or have poor client data protection, which poses significant obstacles to the adoption of new approaches. To keep pace with the market needs, agencies try to accelerate the digital transformation of their working routine: they shift to the cloud and embed AI to automate the processes, use business intelligence to make predictions, protect customers’ data with the help of cybersecurity solutions, optimize their platforms for smartphones and even make them gadgets-friendly via IoT.

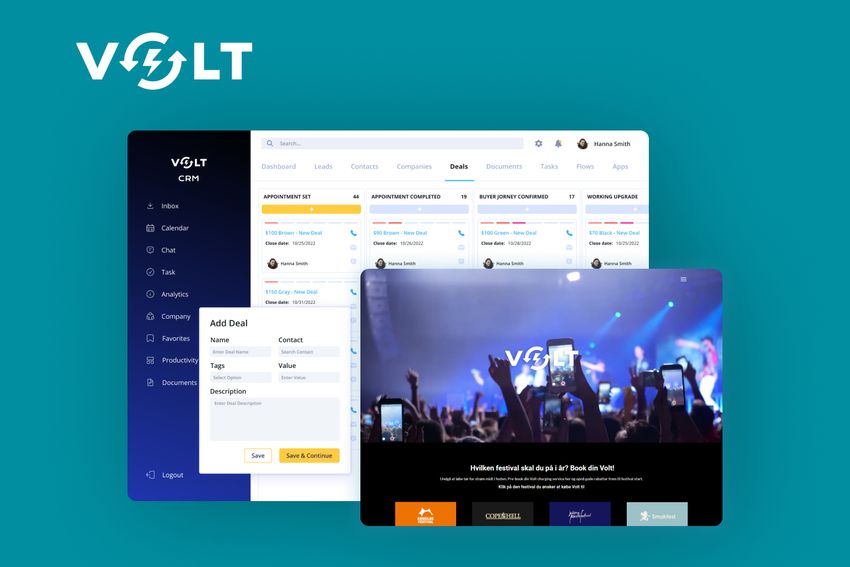

This is an unprecedented burst of technology use, which will reshape the whole industry. At the same time, the life insurance industry tries to cut costs in the short term, thoroughly evaluating the need for each technological upgrade. Moreover, they analyze the cost-effectiveness of ERPs and CRMs used daily, finding the balance between gradual modernization expenditure and cutting costs on outdated management systems.

Workflow Automation and AI Adoption

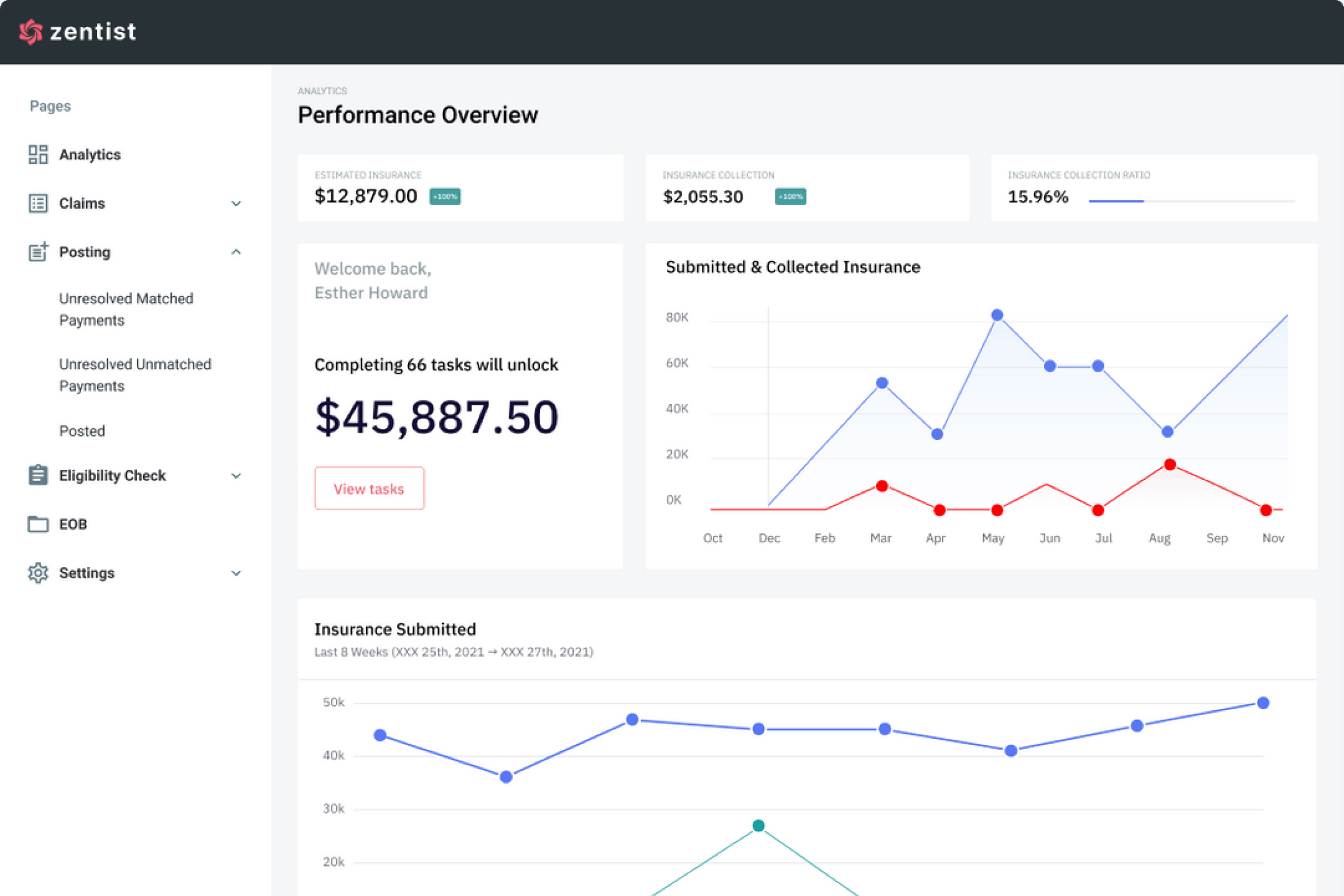

Processing each client's profile manually takes a lot of time, so agencies try to automate the workflow and improve customers' experience with the help of ML and AI. Now these technologies are widely embedded for filling up and updating client profiles, information checks, claims assessment, and settlement. When some information is missing, AI passes the case to the agent and does it several times faster than people.

According to statistics, workflow automation reduces the amount of paperwork by as much as 80% and speeds up claims processing by 50%. What is interesting, insurers regard the customer satisfaction rate as the most important KPI of successful workflow automation.

Use of Data Analytics

During the first wave of the pandemic, insurers were quite unprepared for the ambiguous and almost unpredictable situation on the market, which resulted in great money and client losses and brought new insurance market trends. So now more and more insurers are willing to set up some data analytics tools to be able to predict the upcoming changes and quickly adjust their strategy to the new requirements.

These algorithms can foresee credit reports, shopping habits, or even social media preferences of the clients, and these are just some of their capabilities. Researchers say that the use of BI and Data Analytics tools helps to choose the best pricing policy and detect fraud up to 60% more effectively than before, cutting costs the insurers by 70%.

Shifting to Cloud and Mobile

It's hard for insurers to become customer-oriented and modernize the workflow when all the data is stored in one database with low operability and an outdated technological base. Its functionality requires more costs and skilled technicians, as over time, more and more errors are happening inside. The situation is different with cloud adoption and shifting to SaaS: it allows not only to operate the data in real-time and from any device but also to have direct communication with colleagues and even customers.

With cloud technology in the insurance industry, it’s much easier to share the results of data analytics reports or upgrade the customers’ policies in bulk to overcome insurance industry challenges. For the customers' convenience, insurers even optimize their platforms for smartphones, so people can have 24/7 support and see all the changes real-time. That’s the next level of customer experience standards in the industry.

Insurance Market Outlook 2026: Conclusion

Drawing up a line to our insurance industry analysis, it’s obvious that the insurance domain will never be as it was two years ago. The core changes are taking place right now: legacy modernization, intensive technology adoption, and new corporate culture, as a result of which customers will become the main value of the industry. If you want to keep pace with these changes and get the highest KPIs of customer satisfaction, feel free to contact us and make sure to follow the essential trends in life insurance.

Need Help With A Project?

Drop us a line, let’s arrange a discussion